- Legacy core banking software technology – a solution for some PayTechs

- Microservices architecture is fundamental for the modern core banking software technology

- Choice of the database – Why is it important for the core banking software technology?

- Programming languages and frameworks of the core banking software technology

- API’s importance for the core banking software technology

- Deployment of the core banking software technology: cloud-native or own servers?

- Security is paramount for any core banking software technology

- Mobile apps are an important part of the core banking software technology

- Internet Bank – often neglected by the core software technology

- How Baseella can help

Choosing the right core banking software isn’t rocket science…but it does bear an uncanny resemblance in its complexity. And just like understanding the cosmos isn’t about mastering rocket propulsion overnight, grasping the intricacies of core banking technology isn’t about becoming a banking professional instantly. We’re here to make sure your banking software ‘launch’ is successful.

In this article, we’re going to delve into the nitty-gritty of core banking software technology. We’ll examine the pros and cons of legacy systems, revealing their hidden mysteries. We’ll also explore the types of databases that can be used, demystifying their technical jargon.

Next, we’ll dive into APIs and microservices, understanding their roles and why they’re important. We’ll round out our journey with a look at various types of interfaces and hosting types. So strap in, and let’s make this complex journey as easy as pie.

Legacy core banking software technology – a solution for some PayTechs

Legacy platforms have established themselves as viable solution for certain PayTech companies. These core banking software technology continue to be popular due to their reliability and support level. When integrated with modern front-end and mobile applications through an Application Programming Interface (API), they can effectively serve as a solution for well-funded PayTech start-ups. However, it is important to note that for the vast majority of start-ups (approximately 98%), the high cost associated with legacy platforms poses a significant economic barrier.

One crucial consideration when evaluating legacy core banking software technology is that they often have various products and services hardcoded into their core architecture. As a result, incorporating new payment methods and rolling out innovative products becomes a complex and costly process. To address this challenge, significant investment is required to develop and maintain a proprietary external microservices engine. In this setup, the legacy core banking system primarily functions as a system of records, or a general ledger, while the external microservices engine enables the development and deployment of new payment methods and products in a timely manner. Without this investment, PayTechs may find themselves unable to keep up with the rapidly evolving market demands, hindering their ability to innovate and potentially limiting their growth opportunities.

The need for agility and flexibility in today’s financial landscape cannot be overstated. Start-up PayTechs must be able to adapt swiftly to emerging trends and customer demands. Legacy systems, although reliable, often lack the necessary flexibility to accommodate these changes without substantial investments and modifications. By relying solely on a legacy core banking system, PayTechs risk falling behind their competitors in terms of product offerings and customer experience.

Microservices architecture is fundamental for the modern core banking software technology

In the realm of modern banking, core banking software technology has undergone significant transformations. It is widely acknowledged by industry specialists that a prevalent architecture for such software is the three-tier architecture. This architecture encompasses the front-end customer engagement layer, the intermediate microservices layer, and the backend responsible for housing the core banking modules. However, it is important to note that this approach, although widely adopted, has been in existence for at least a decade.

A paradigm shift has occurred within the banking industry, with the emergence of microservices as the new core of modern core banking software technology. Microservices are self-contained, independently deployable components that encapsulate specific business functionalities. Each microservice operates with its own dedicated database and communicates with other microservices through well-defined interfaces. The orchestration and deployment of these microservices are facilitated by popular containerisation technologies like Docker, while the management and scaling of these containers are efficiently handled by platforms such as Kubernetes.

The adoption of this microservices-based architecture offers immense advantages. By granting each microservice maximum autonomy, the system ensures that if one microservice encounters a failure or undergoes maintenance, others can continue to function seamlessly. This fault isolation capability enhances system reliability and resilience. Furthermore, microservices’ distributed nature allows flexibility in designing and implementing PayTech’s customer journeys, products, and services. PayTechs can leverage the modular nature of microservices to rapidly prototype, iterate, and refine their offerings, responding swiftly to market demands and customer expectations.

Conversely, legacy core banking platforms often suffer from inherent limitations. The business logic is often deeply integrated into the core, resulting in monolithic architectures that hinder scalability and agility. Expanding functionality or introducing new features becomes a challenging task requiring extensive monolithic structure modifications. Recognising the need to keep pace with the dynamic requirements of PayTechs, there is a growing realisation that breaking down the monolithic architecture and redistributing the business logic into independent microservices is essential.

By decomposing the business logic into discrete microservices, PayTechs can achieve greater modularity and maintainability. Each microservice represents a specific business capability, such as account management, transaction processing, or risk assessment. These microservices can be developed, deployed, and scaled independently, enabling PayTechs to rapidly modify or introduce new business processes and payment methods. This newfound agility empowers PayTechs to swiftly adapt to evolving market trends, customer preferences, and regulatory requirements.

Moreover, the shift towards microservices brings about a transformative shift in the development and management of core banking systems. Traditionally, changes to the system were predominantly carried out by IT personnel due to the intricate nature of the monolithic architecture. However, with microservices, the boundaries between technology and business operations blur. Non-IT personnel, such as product managers and business analysts, gain the ability to introduce modifications or create new services without directly altering the core. This democratisation of system management fosters collaboration between business and technical teams, streamlines decision-making processes, and accelerates innovation cycles.

Looking towards the future, technology will continue to evolve, and PayTechs must remain adaptable. Vertical and horizontal decoupling of the core banking system is becoming imperative. This approach allows for a plug-and-play ecosystem where PayTechs can seamlessly integrate various technologies, third-party services, and payment methods. The foundation provided by the core banking system acts as a solid base upon which PayTechs can build multiple layers of functionality, expanding their service offerings and exploring new revenue streams.

Furthermore, as technology and customer expectations evolve, PayTechs must continuously innovate to stay competitive. The modular nature of microservices enables PayTechs to embrace emerging technologies and payment methods without disrupting the core banking system. PayTechs can swiftly adapt to changing market trends and customer demands by plugging in new services, APIs, and integrations. This plug-and-play approach reduces development cycles, enables experimentation with innovative features, and fosters a culture of continuous improvement.

Additionally, scalability and performance are critical factors in the success of modern core banking systems. As PayTechs expand their customer base and transaction volumes increase, the system must be capable of scaling horizontally and vertically to handle the growing load. Employing technologies such as auto-scaling, load balancing, and caching mechanisms ensures optimal system performance, responsiveness, and reliability even during peak usage periods. The ability to scale the infrastructure seamlessly enables PayTechs to meet customer demands without compromising service quality.

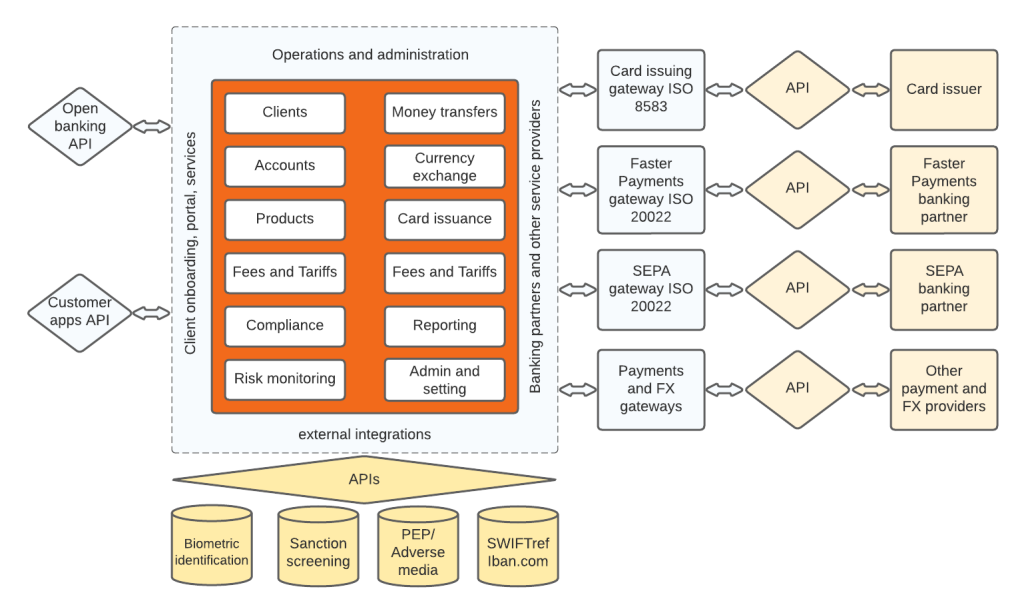

Below, you can have a look on how a modern core banking software architecture could be broken down into microservice blocks:

Choice of the database – Why is it important for the core banking software technology?

The choice of database for a modern core banking system is a crucial decision that can significantly impact a company’s operations and costs. While using databases like MS SQL or Oracle is not inherently problematic, one key factor that must be considered is the license cost associated with these proprietary databases. Licensing costs can quickly increase, as organisations typically pay for development, staging, and production servers. For example, MS SQL Server Enterprise Edition can cost $7,128 per core per annum. The annual cost can quickly escalate when considering the need for multiple servers, reaching at least $21,384.

This financial burden becomes a major concern, particularly for start-ups and smaller organisations with limited budgets. Many such companies are opting for core banking software technology built on free and open-source databases like PostgreSQL. PostgreSQL has a proven track record in mission-critical environments and high-volume systems within the financial services sector. By leveraging PostgreSQL, organisations can significantly reduce their licensing costs while maintaining the reliability and performance required for core banking operations.

The choice of the operating system is also an important consideration when selecting a database for a core banking system. PostgreSQL offers extensive compatibility across various operating systems, including Linux (all recent distributions), Windows (Win2000 SP4 and later), FreeBSD, OpenBSD, NetBSD, Mac OS X, AIX, HP/UX, IRIX, Solaris, Tru64 Unix, and UnixWare. In contrast, MS SQL is limited to Windows, Windows Server, and Linux. This broad compatibility ensures that organisations have the flexibility to select the operating system that best suits their infrastructure and business requirements.

Additionally, PostgreSQL supports a wide range of programming languages, making it easier to find software engineers with the necessary skills for developing and managing the core banking system. The supported languages include Python, Tcl, .NET, C, C++, Delphi, Java, JavaScript (Node.js), and Perl. This diverse language support allows organisations to leverage their preferred programming languages and frameworks, ensuring a smooth development and maintenance process.

By choosing PostgreSQL as the database for a modern core banking system, organisations can effectively manage costs, benefit from extensive compatibility with various operating systems, and tap into a larger pool of software engineering talent. These advantages contribute to a more flexible, scalable, and cost-effective solution, empowering organisations to meet the evolving needs of the financial industry while maintaining a strong foundation for their core banking operations.

Programming languages and frameworks of the core banking software technology

Using open-source programming languages and frameworks in the development of the modern core banking software technology offers several benefits for the modern core banking system. First off, they are cost-effective. Being free to use, they significantly cut down on software development costs. This allows especially smaller organisations and start-ups, constrained by limited budgets, to redistribute resources more efficiently, steering clear of the hefty expenses tied to proprietary licenses.

Secondly, open-source technologies are bolstered by a dynamic community of developers and contributors. These communities foster a collaborative environment, sharing knowledge and incessantly evolving programming languages and frameworks. This enables organisations to tap into a reservoir of expertise and resources, profiting from community-driven enhancements, security patches, and bug fixes.

Moreover, the flexibility and customisation options of open-source solutions are unparalleled. Organisations can modify these technologies to align with their specific needs, creating a core banking system that fits their business requirements like a glove. Developers can delve directly into the source code, introducing changes and expanding functionality to design a more bespoke and adaptable system.

Open-source languages and frameworks have a high adoption rate, which contributes to their maturity and stability. With rigorous testing and extensive real-world application, including in core banking systems, these technologies have proven their reliability and performance.

What’s more, they’re designed for interoperability, providing seamless integration capabilities with both open-source tools and proprietary systems. This facilitates the smooth fusion of different core banking system components, such as external APIs, databases, and third-party services, ensuring a streamlined flow of data and transactions.

Lastly, open-source technologies stimulate a culture of rapid innovation and evolution. Developers are spurred to contribute enhancements and new features, sparking faster innovation compared to closed-source counterparts. Therefore, organisations can seize the latest advancements in programming languages and frameworks, staying on the cusp of technological developments in the core banking industry.

In a nutshell, open-source programming languages and frameworks present a bouquet of benefits for the modern core banking system – cost-effectiveness, a vibrant community, flexibility, wide adoption, seamless integration, and rapid innovation, equipping organisations to build robust, scalable, and adaptable core banking systems while optimising their resources in a rapidly changing industry landscape.

API’s importance for the core banking software technology

In the realm of modern transactional banking start-ups, PayTech’s success greatly relies on utilising service APIs to provide services and data from various platforms. These APIs play a mission-critical role and can ultimately determine the fate of the business. Today, most core banking software engineering teams opt for the RESTful architectural style of APIs, compared to the SOAP APIs that were standard for legacy systems.

Due to their SSL (Secure Socket Layer) and WS-security features, SOAP APIs are still preferred for cases involving sensitive data like Bank Account Passwords and Card Numbers. However, REST APIs leverage multiple standards such as HTTP, JSON, URL, and XML for data communication and transfer, resulting in reduced resource usage and bandwidth compared to SOAP APIs. REST APIs, being HTTP-based, offer a simplified development experience. Additionally, REST can still make use of SOAP as the underlying protocol for web services since it is ultimately an architectural pattern. It is essential for APIs to be developed as stateless as possible, avoiding the maintenance of client state on the server.

Looking ahead, future core banking software technology API developers are increasingly turning to GraphQL, an open-source data query and manipulation language for APIs. Initially developed by Facebook and later made open-source under the GraphQL Foundation, GraphQL is designed to make APIs fast, flexible, and developer-friendly. GraphQL enables developers to construct requests that retrieve data from multiple sources in a single API call. This capability holds particular significance for core banking software technology, where various microservices form the core instead of relying on the monolithic structure of legacy core banking systems (which we already discussed). GraphQL empowers clients to define the structure of the required data, ensuring that only the requested data is returned from the server. This prevents excessive amounts of data from being transmitted and enhances the efficiency and performance of API calls.

By adopting GraphQL, modern core banking software technology developers unlock the potential for faster and more flexible data retrieval, enabling seamless integration of disparate data sources. The ability to pull data from multiple sources in a single request simplifies the development process, reduces network round trips, and minimises latency. Furthermore, GraphQL’s ability to precisely specify the required data structure helps to optimise network usage, ensuring that only relevant information is transferred between the client and the server. This not only improves performance but also reduces bandwidth consumption, benefiting both the end users and the overall scalability of the core banking system.

In conclusion, the choice of APIs is crucial for modern core banking systems, and the REST architectural style has become the preferred approach for most software engineering teams. However, the emergence of GraphQL offers a compelling alternative that empowers developers to efficiently retrieve data from multiple sources in a single API call. By leveraging GraphQL, modern core banking software technology can enhance performance, flexibility, and developer productivity, ultimately providing a superior banking experience to customers while minimising data transmission costs.

Deployment of the core banking software technology: cloud-native or own servers?

In the modern transactional banking service provision, cloud hosting has become the new norm, offering numerous benefits to PayTechs. Maintaining an in-house hosting centre, which often needs to comply with stringent PCI DSS regulations, can be a costly and complex endeavor. Fortunately, major cloud providers like AWS, Google Cloud, Microsoft Azure, and others offer fully managed hosting environments that provide PayTechs with an array of advantages. When selecting core banking software technology, PayTechs need to consider cloud hosting options, taking into account regulatory factors, the availability of fully managed hosting for specific databases, and cost considerations. The more flexible PayTechs are in terms of hosting locations, the better equipped they will be to meet their specific needs.

In the context of cloud-native deployments, containerisation technologies like Docker have gained immense popularity. Docker enables the encapsulation of application components and dependencies into lightweight, portable containers. By packaging microservices within containers, PayTechs can achieve greater flexibility, scalability, and consistency in their deployments. Containers provide isolation, ensuring that each microservice runs independently, with its own set of resources and dependencies.

Furthermore, container orchestration platforms such as Kubernetes facilitate efficient management and scaling of these containers. Kubernetes automates the deployment, scaling, and management of containerised applications. It simplifies the process of managing microservices at scale, allowing PayTechs to efficiently handle the complexities of their core banking systems. Kubernetes provides features like auto-scaling, load balancing, and self-healing, ensuring high availability and resilience of the deployed microservices.

When it comes to the choice of hosting databases, PostgreSQL, a popular open-source database, offers extensive deployment options. It can be installed and managed in a wide range of operating systems and environments, including FreeBSD, HP-UX, Linux, NetBSD, OpenBSD, macOS, Solaris, Unix, and Windows servers. Fully managed PostgreSQL hosting is available on major cloud platforms like AWS, Azure, Google Cloud, and DigitalOcean. These services provide high availability and offer SSH access, enabling PayTechs to leverage multi-cloud Database-as-a-Service (DBaaS) solutions. Additionally, PostgreSQL offers the flexibility for PayTechs to host and operate the database from their privately-owned data centres if desired.

By adopting a cloud-native approach and leveraging containerisation technologies like Docker, along with container orchestration platforms like Kubernetes, PayTechs can reap numerous benefits. They can achieve seamless deployment and management of microservices, ensuring scalability and efficient resource utilisation. Containers provide a consistent runtime environment, reducing deployment inconsistencies and simplifying the development and deployment processes. Kubernetes adds an extra layer of control and automation, facilitating effortless scaling, monitoring, and fault tolerance.

Whether PayTechs choose cloud-native deployments or opt to host their own servers, the availability of containerisation technologies like Docker and orchestration platforms like Kubernetes empowers them to efficiently manage and scale their microservices. This, coupled with the flexibility of PostgreSQL hosting across various environments, allows PayTechs to focus on delivering exceptional banking services while leaving the complexities of infrastructure management and deployment to trusted technologies and platforms.

Security is paramount for any core banking software technology

Ensuring the highest level of security is paramount when it comes to core banking software technology. The success of a secure core banking system or payment system hinges on an unwavering commitment to state-of-the-art application security, which aligns with the consistent objectives of the market. It is imperative that the vendor organisation responsible for the core banking system demonstrates proper management of information security and incorporates robust security considerations into their product.

A reputable vendor of core banking systems should have implemented an Information Security Management System (ISMS) that encompasses specific areas and processes within their organisation. The software development processes should fall within the purview of their ISMS, ensuring that security measures are ingrained throughout the software’s lifecycle. These vendors typically adhere to international standards such as ISO/IEC 27001 and, in some cases, undergo certification of their management systems by an independent third party, further validating their commitment to security.

In cases where card issuance projects are managed within the core banking software, compliance with the Payment Card Industry Data Security Standard (PCI DSS) becomes essential to meet card scheme rules. Obtaining PCI DSS certification involves undergoing quarterly ASV scans, annual audits, and re-certification. To maintain a robust security posture, it is crucial for each PayTech that licenses a white-label core banking system to conduct periodic vulnerability and penetration testing. These tests should be carried out upon the introduction of new features, updates, or significant modifications, with a minimum frequency of every six months. The results of such testing should be shared with PayTech by the core banking software vendor, ensuring transparency and enabling timely mitigation of any identified vulnerabilities. Moreover, it is advisable for third-party IT security auditors to perform independent vulnerability and penetration tests on the core banking software at least once a year, providing an additional layer of assurance.

Security measures form the bedrock of modern core banking technology, ensuring the protection of sensitive financial data and maintaining the trust of customers and stakeholders. To achieve robust security, several key measures should be embedded into the core banking software technology:

- A secure core banking system implements strong access controls and authentication mechanisms. This includes user authentication with password policies, multi-factor authentication, and role-based access control (RBAC) to restrict system access based on user roles and responsibilities. Encryption techniques, such as secure socket layer (SSL) certificates, are utilised to protect data in transit.

- Encryption is crucial for safeguarding sensitive information, such as customer account details, transaction records, and authentication credentials. Modern core banking software technology employs strong encryption algorithms to encrypt data at rest and in transit, ensuring that the data remains unreadable and unusable even if unauthorised access occurs.

- The core banking software technology should be developed following secure coding practices, adhering to industry-recognised guidelines and standards such as the Open Web Application Security Project (OWASP). These practices involve input validation, output encoding, and protection against common vulnerabilities like cross-site scripting (XSS), SQL injection, and cross-site request forgery (CSRF).

- Implementing Intrusion Detection and Prevention Systems (IDS/IPS) solutions helps detect and prevent unauthorised access attempts and malicious activities within the core banking system. These systems monitor network traffic, detect suspicious patterns, and block potential threats in real time, bolstering the overall security posture.

- Logging and monitoring are essential for proactive threat detection and incident response. By implementing comprehensive log management and monitoring systems, the core banking software technology can track and analyze system activities, detect anomalies, and provide an audit trail for forensic investigation in case of security incidents.

- Regular security audits and penetration testing are vital to identify vulnerabilities and weaknesses within the core banking software technology. External security experts should conduct thorough assessments to uncover potential flaws, simulate real-world attacks, and validate the effectiveness of security controls. Addressing the identified vulnerabilities promptly ensures the continuous improvement of the system’s security.

- Keeping the core banking software technology up to date with the latest security patches is crucial to address known vulnerabilities and prevent exploitation by malicious actors. Regular patch management processes should be established to ensure timely updates and minimise the risk of security breaches.

- Robust disaster recovery and business continuity plans must be in place to ensure seamless operations in the face of disruptions or disasters. This includes regular data backups, redundant systems, off-site data storage, and comprehensive incident response procedures to minimise downtime and maintain service availability.

- Well-trained employees are a crucial line of defense against security threats. Core banking software vendors should provide comprehensive security awareness training to their employees, educating them about best practices, social engineering attacks, and the importance of data protection. This helps create a security-conscious culture within the organisation.

By incorporating these security measures into modern core banking technology, developers can establish a secure and resilient infrastructure that protects critical financial data, ensures regulatory compliance, and instills confidence in customers and stakeholders. These measures should be continuously reviewed, updated, and tested to adapt to evolving security threats and maintain a robust security posture in an ever-changing landscape.

Mobile apps are an important part of the core banking software technology

Mobile applications play a vital role in the provision of transactional banking services for PayTechs, offering a user-friendly, secure, and reliable interface for customers. The development of mobile apps often leverages cross-platform development frameworks such as Xamarin, Flutter, and Kotlin Multiplatform. These frameworks enable IT engineers to build mobile applications using a single code base that can be deployed across multiple operating systems, saving time and effort by avoiding the need to write native code for each platform individually. Additionally, the use of a reusable code base allows for efficient bug resolution and the implementation of enhancements across all platforms simultaneously.

While cross-platform development offers advantages in terms of code reuse and development efficiency, it may not be the ideal approach for neo-banking apps. Performance is a crucial consideration for any mobile app, and native applications exhibit slightly better performance than their cross-platform counterparts. Native apps can fully leverage the capabilities and features of the underlying operating system and devices, resulting in smoother user experiences. In contrast, cross-platform apps may face limitations in utilising native application interfaces, leading to potential compromises in customer experience. Developers working on cross-platform apps must handle specific exceptions and platform differences, particularly for more complex features, which can introduce additional complexity and development effort.

Native apps also benefit from timely updates and support for new features introduced by operating system providers. Google and Apple regularly release new features and updates for Android and iOS, providing developers of native apps with updated software development kits (SDKs) in a timely manner. Cross-platform frameworks may experience delays in supporting these new features, requiring developers to wait for updates from the framework providers before incorporating the latest functionality into their apps.

Furthermore, there is a risk associated with cross-platform development frameworks becoming unsupported or discontinued, as exemplified by the case of Xamarin. If a framework loses support, it may lead to compatibility issues, security vulnerabilities, and the need for migration to alternative solutions, potentially disrupting the development and maintenance of cross-platform apps.

In contrast, native app development allows developers to focus on solving user problems and take advantage of the latest features and updates provided by the platform providers. The native approach ensures optimal performance, better utilisation of device capabilities, and the ability to provide a seamless user experience.

While cross-platform development frameworks offer advantages in terms of code reuse and development efficiency, PayTechs need to carefully evaluate the specific requirements of their mobile applications. For neo-banking apps that demand high performance, rich user experiences, and seamless integration with native device capabilities, native app development may be preferred. It is essential to weigh the trade-offs between development efficiency and app performance to deliver customers the best possible mobile banking experience while considering long-term support and compatibility considerations.

Internet Bank – often neglected by the core software technology

The demand for a well-designed and intuitive web banking portal remains significant, particularly among corporate customers, despite the increasing popularity of mobile apps for accessing transactional banking services. While mobile apps are preferred by most private individuals, corporate customers rely on web interfaces accessed through laptops or desktops as part of their daily routine. Therefore, it is crucial for PayTechs to offer a robust web banking application that works seamlessly across all popular browsers.

A modern core banking software technology for web banking should address the specific requirements of corporate customers. This includes providing different user access levels and rights to accommodate various roles within an organisation. Additionally, the web banking portal should support features such as the ability to have multiple signatories for payment orders, enabling a secure and controlled process for preparing, signing, and executing transactions. The system should also offer the capability to store unlimited statement data, allowing customers to access historical transaction records, even going back several years.

Security is of utmost importance in web banking, and two-factor authentication is a fundamental requirement. While mobile apps can implement two-factor authentication seamlessly using features like fingerprint or face ID, web banking typically relies on password-based authentication combined with One-Time Passwords (OTP) delivered via SMS or generated using a digipass. These additional authentication layers help ensure the security of customer accounts and protect against unauthorised access.

Moreover, corporate customers require access to web banking APIs to integrate their enterprise management solutions, such as invoicing and accounting apps, with their banking accounts. By leveraging secure web banking APIs, businesses can retrieve financial data from their accounts in a safe and reliable manner. They can also automate the process of uploading payment orders directly into the banking system via the API, eliminating the need for manual data entry.

A comprehensive web banking solution caters to the unique needs of corporate customers, offering a user-friendly interface, robust security measures, and seamless integration capabilities. PayTechs should prioritise the development and optimisation of their web banking applications to ensure a positive user experience, enhanced security, and efficient integration with business management solutions. By providing a well-rounded web banking portal, PayTechs can meet the diverse demands of their customer base and strengthen their position in the competitive transactional banking market.

How Baseella can help

Opting for a top-tier cloud-based SaaS core banking software technology provider like Baseella presents a myriad of benefits over creating an in-house solution. Primarily, it fast-tracks your entry into the market, enabling PayTech institutions to swiftly debut and scale their services, bypassing the need for laborious development and infrastructure establishment. Furthermore, it unburdens you from the upkeep and upgrades of intricate software. With Baseella, you can bid adieu to worries about regular updates, security patches, and system enhancements—they’ve got you covered. Financially, it makes sense too. Baseella takes a hefty load off your shoulders by removing the necessity for considerable initial investments in infrastructure, development resources, and ongoing maintenance. Not to mention, Baseella grants access to sophisticated features, such as API integrations, automation capabilities, and regulatory compliance tools. These allow financial institutions to keep their edge, satisfying shifting customer expectations. Finally, the scalability and adaptability of a cloud-based core banking software technology like Baseella ensure fluid growth and effortless integration with other systems. This secures your adaptability to ever-changing business requirements and technological progressions.