In the intricate web of financial transactions, the cornerstone of large-value and high-priority euro settlements is the Trans-European Automated Real-time Gross Settlement Express Transfer System, fondly known as TARGET2. Developed by the collective might of the Eurosystem, comprising the European Central Bank (ECB) and the national central banks of the Eurozone, TARGET2 is a robust infrastructure ensuring the fluidity and safety of substantial financial transactions.

High-Stakes Real-Time Gross Settlement (RTGS) #

TARGET2, in its might, handles Real-time Gross Settlement (RTGS), facilitating the instantaneous settlement of large-value payments. The system is key in overseeing financial transactions of great importance, including interbank transfers, securities settlements, and large-scale commercial payments. This RTGS feature of TARGET2 ensures the prompt, final transfer of funds between participating banks – a fundamental feature for high-stakes transactions.

Eurosystem Operations: The Monetary Policy Wheel #

TARGET2 plays a vital role in the orchestration of Eurosystem operations associated with monetary policy and liquidity management. Activities such as refinancing operations, open market operations, and reserve management conducted by central banks are firmly rooted in TARGET2’s versatile capabilities.

The Ancillary Systems Integration #

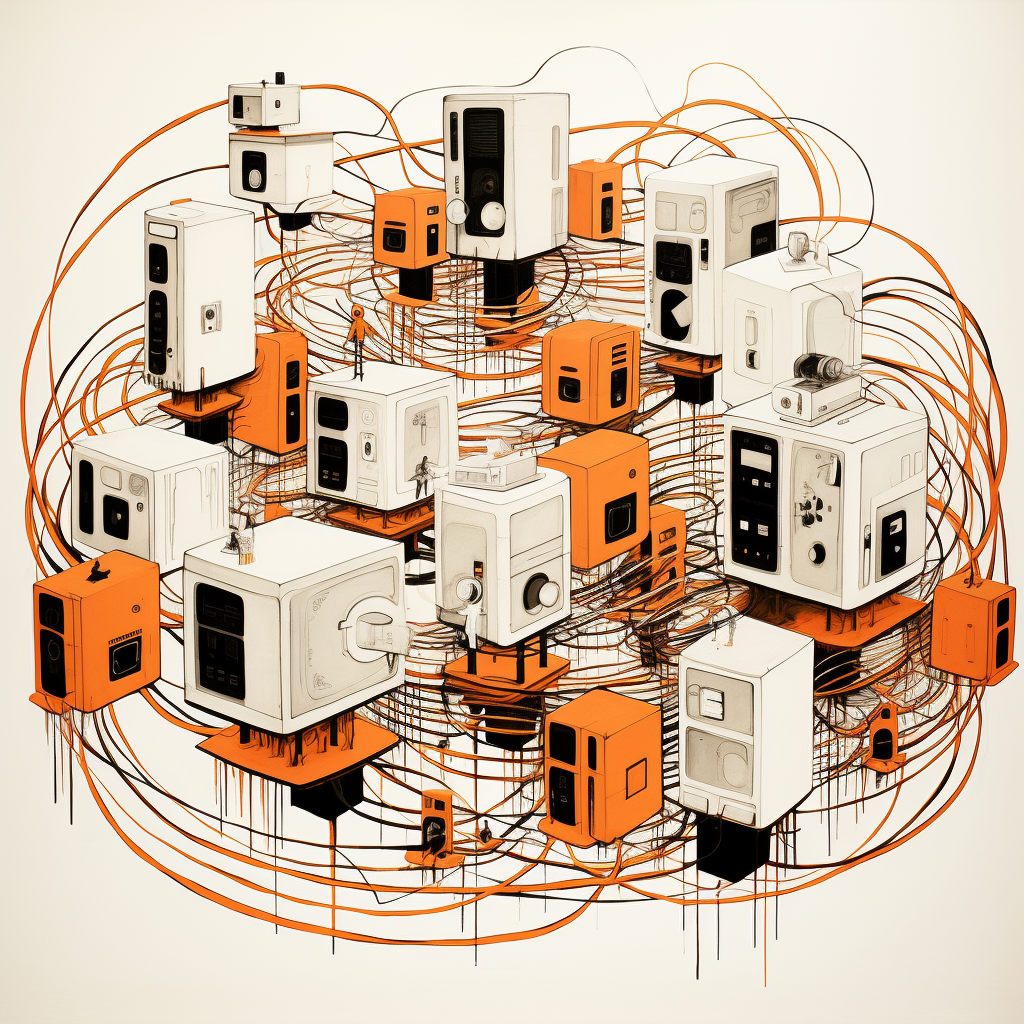

TARGET2 extends beyond being a simple payment system. Its integration capabilities with other ancillary systems including securities settlement systems like TARGET2-Securities (T2S) and collateral management systems demonstrate its advanced operational prowess. This ensures a seamless coordination and settlement of transactions across multiple platforms, embodying the true spirit of interoperability.

Bridging Borders: Cross-Border Payments #

Beyond domestic horizons, TARGET2 is pivotal for cross-border payments within the Eurozone. Providing a harmonized and efficient settlement infrastructure, it ensures the smooth, reliable transfer of funds between participating banks across different countries. This strengthens the integration and stability of the European financial system, building trust and reliability in transnational transactions.

By integrating TARGET2, financial institutions ensure that high-value payments are settled securely and in real time. This powerhouse of a system plays an invaluable role in the efficient and stable execution of payment transactions within the Eurozone. It supports the functioning of the single currency and the broader European financial market, hence confirming its position as an essential cog in the wheel of the financial machinery.