The Single Euro Payments Area (SEPA) has carved a pivotal niche in the realm of European electronic payments. By standardizing euro payments across a myriad of European countries, SEPA has led the charge towards a more coherent and efficient financial system. Covering an impressive span of 36 countries, including members of the European Union (EU) and the European Free Trade Association (EFTA), the SEPA vision embraces uniformity and ease of transactions within the SEPA region.

SEPA: An Array of Payment Transactions #

SEPA’s versatility is evident in the variety of payment transactions it facilitates:

- SEPA Credit Transfer (SCT): SCT empowers individuals and businesses to dispatch electronic credit transfers in euros across the SEPA region. This bolsters speedy and efficient money movements between bank accounts, fostering a dynamic financial environment.

- SEPA Direct Debit (SDD): SDD equips businesses to collect payments directly from customers’ bank accounts using a sanctioned direct debit mandate. Typically used for recurring payments such as utility bills, subscriptions, and loan repayments, SDD exemplifies the efficiency of the SEPA system.

- SEPA Instant Credit Transfer (SCT Inst): Introduced in 2017, SCT Inst brings near-instantaneous credit transfers to the table. Ensuring real-time availability of funds, it facilitates immediate payments between participating banks, adding another feather to SEPA’s cap.

- SEPA Card Clearing: This aspect of SEPA handles card-based payment transactions. Whether it’s card payments or ATM withdrawals executed with SEPA-compliant cards, this facet guarantees interoperability and consistent payment experiences across various SEPA countries.

The Mechanics of SEPA Transactions #

SEPA transactions leverage the International Bank Account Numbers (IBANs) and Bank Identifier Codes (BICs) to identify bank accounts and smoothen the path for cross-border payments within the SEPA territory. The standardized formats and protocols in place guarantee seamless interoperability among participating banks and payment service providers, reinforcing the unification ethos of SEPA.

SEPA: A Paradigm Shift for Euro Payments #

SEPA’s overarching aim is to uncomplicate and streamline euro payments, turning cross-border transactions into a process as simple and cost-effective as domestic payments. By promoting competition, efficiency, and transparency in the European payments market, SEPA furnishes a consistent framework for payment services across participating nations.

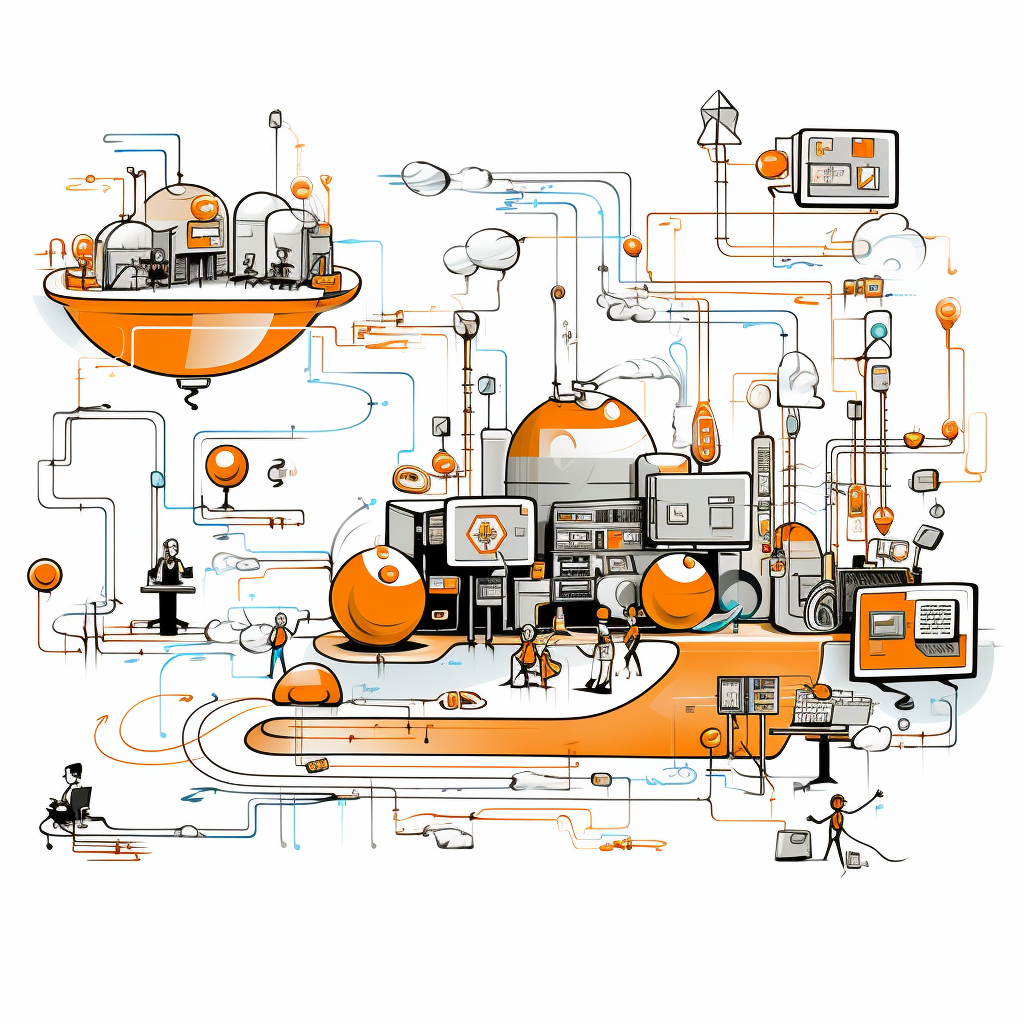

In summary, SEPA payments represent an unprecedented stride in the European financial landscape, fostering simplicity, efficiency, and coherence in euro payments. As a lynchpin of European financial integration, SEPA is indeed a force to be reckoned with. Baseella is made ready for you to start providing SEPA payments and has all of the integrations required for that.