- Embedded regulatory reporting is a must-have in the bank compliance software

- User access rights management is an essential part of the bank compliance software

- Sensitive payment data protection must be embedded in the bank compliance software

- Embedded onboarding and CDD within the core banking software

- AML/CTF functionality of the bank compliance software

- PEP and sanctions screening functionality of the bank compliance software

- Risk scoring and transaction monitoring functionality of the bank compliance software

- How Baseella can help

Why the core banking system is the backbone of bank compliance software? Banking, payments, and electronic money services is a highly regulated sector, and all PayTechs must have adequate core banking or payment software in place to ensure compliance. For simplicity, we’ll refer to electronic money institutions and payment institutions that are providing transactional banking services as banks or PayTechs. This article will discuss 8 reasons why the core banking system is the backbone of the bank compliance software and what should be borne in mind by the PayTech firms when choosing their core banking software, starting with those that are aiming to ease reporting and ending with those that are essential for compliance with regulatory obligations.

Embedded regulatory reporting is a must-have in the bank compliance software

When selecting a core banking software for a bank or a Paytech firm, one crucial consideration is the ease of regulatory reporting. Regulators demand timely and accurate reports, making it essential for banks to choose a software solution that can efficiently generate the necessary reports. While most legacy core banking systems possess some reporting functionality, many modern solutions fall short in meeting these regulatory requirements. In this section, we will explore the significance of regulatory reporting and how the right core banking system, acting as a backbone of the bank compliance software, can streamline this process for banks and PayTechs.

A robust core banking software should offer comprehensive reporting capabilities to satisfy regulatory expectations. Banks and PayTechs need to assess the software’s ability to generate various reports, such as customer statistics based on residency or incorporation, payment turnover, payment method analysis, transaction volumes, regional and cross-border payment statistics, SCA and non-SCA payment authorisation methods, and much more. Additionally, reports on fund safeguarding, balance sheets, profit and loss statements, ongoing capital and future capital adequacy are vital for compliance purposes. If an inadequately designed core banking system cannot produce the required data or information, a bank or a PayTech may need to deploy additional bank compliance software that is capable of recording, disseminating, and reporting required data.

While many European regulators, especially for the PayTech sector, still rely on manual report submissions, some are moving towards automated reporting via API. Various regulators are continuously publishing their advisories on inadequate and erroneous regulatory reporting and calling banks and PayTech firms to enhance the accuracy and improve the timeliness of their reports. Banks and PayTechs should consider only core banking systems that support automated reporting, and function as bank compliance software, as it ensures compliance, frees up valuable human resources, and saves time. Automated reporting reduces the risk of errors and enables PSPs to meet regulatory deadlines seamlessly.

Another crucial aspect of regulatory compliance is that the properly designed core banking software must be built around the general ledger transactions, and support a full chart of accounts and intra-company accounting. Without these capabilities, banks and PayTechs cannot effectively produce management accounts, and financial statements, conduct calculations related to ongoing capital adequacy, conduct safeguarding accounts reconciliations, etc. Separating accounts across multiple systems complicates reporting processes and delays the production of timely and accurate reports. PSPs must choose the core system, that effectively acts as a bank compliance software that enables them to consolidate all accounting functions within a single platform.

User access rights management is an essential part of the bank compliance software

When it comes to regulatory compliance in the PayTech industry, the design of user rights within PayTech’s core banking software plays a crucial role. Meeting data protection regulations, protecting sensitive payment data, ensuring proper governance and controls, and mitigating insider threats are all essential aspects of compliance. Unfortunately, we have observed a lack of robust user rights management in many newly developed core banking solutions, leading to potential compliance breaches. So, let’s explore the significance of user rights design in bank compliance software and the importance of implementing proper governance and control measures.

In some inadequately designed core banking solutions, a single user with a specific profile can perform multiple critical actions without adequate oversight. They can onboard customers, process payment transactions, approve transactions, and even bypass the red flag alerts generated by the Anti-Money Laundering (AML) system. Such deficiencies in governance and control pose serious compliance risks. The absence of the “four eyes” principle, where actions require review and approval from multiple authorised users (financial institution employees), compromises regulatory compliance and increases the vulnerability to fraudulent activities.

PayTechs need bank compliance software that emphasises proper governance and control through robust user rights management to address these challenges. This includes implementing role-based access controls (RBAC) to ensure that each user has appropriate permissions based on their responsibilities and job functions. RBAC helps enforce the segregation of duties, reducing the risk of unauthorised activities and enhancing compliance. Additionally, multi-step approval workflows should be implemented, ensuring critical actions (for example, any actions, related to the customer’s funds) require review and approval from multiple authorised users. This principle enhances accountability and reduces the potential for insider threats.

Effective user rights management within bank compliance software offers numerous benefits beyond regulatory compliance. It enhances data protection by limiting access to sensitive information only to authorised individuals. User rights management also enables traceability, making identifying who performed specific actions within the system easier, and aiding in audits and investigations. By enforcing proper governance and control measures, PayTechs can build a culture of compliance, foster trust among regulators, and enhance the overall security of their operations.

Sensitive payment data protection must be embedded in the bank compliance software

When it comes to bank or PayTech compliance, ensuring the security and privacy of sensitive customer payment data is of utmost importance. Protection of sensitive payment data is a legal and regulatory requirement in most countries. Careful design of the user rights within a core banking software plays a critical role in controlling access to this data and preventing unauthorised individuals from viewing or handling it.

To maintain compliance and protect customer information, user rights should be meticulously designed to grant access only to individuals who require it for their specific job functions. For instance, payment officers and AML/CTF personnel should be the only ones with access to sensitive customer payment data. Individuals in marketing and sales roles should not have access, even if they use the core banking software for sending mass-marketing communications. Similarly, customer service personnel should have limited access to sensitive payment data. Implementing measures like masking remitter/beneficiary names when customer service personnel are logged in can effectively restrict their access to sensitive information.

Another crucial aspect of user rights management in bank compliance software is controlling data export and printing capabilities. Exporting sensitive payment data to formats like CSV or Excel, or printing it, should be restricted to authorised users only. Individuals such as the Money Laundering Reporting Officer (MLRO), Chief Compliance Officer, or CEO should be granted these privileges. By enforcing such restrictions, PSPs can ensure that sensitive data remains within the system and is not vulnerable to unauthorised disclosure or mishandling.

Implementing robust user rights management in bank compliance software offers significant benefits beyond regulatory compliance. It helps prevent data breaches by limiting access to sensitive customer payment data to only those who require it for their roles. This reduces the risk of internal threats and unauthorized data disclosures. Additionally, strict user rights management fosters customer trust, as it demonstrates a commitment to protecting their information and complying with data protection regulations.

While user rights management plays a crucial role in protecting sensitive payment data, Banks and PayTechs must employ additional technical measures within their core banking systems to ensure comprehensive data security.

One of the fundamental technical measures for protecting sensitive payment data is encryption. Financial institutions should implement strong encryption algorithms to encrypt data both at rest and in transit. By encoding the data into an unreadable format, even if unauthorised access occurs, the information remains unintelligible and unusable to malicious actors.

Moving further, embracing tokenization technology can add a formidable layer to data protection. This technique substitutes sensitive payment data, such as Payment Card PAN, with unique tokens, while securely storing the actual data in a separate, highly guarded environment. By facilitating transactions through tokens, the original sensitive data stays isolated, significantly mitigating risks associated with data exposure during transmission or storage.

To fortify the communications between clients and servers, the deployment of Secure Socket Layer (SSL) or TLS protocols is advisable. Ensuring data transmitted over networks, such as internet connections, remain confidential, these encryption protocols offer a strong defense against unauthorized interception or tampering.

For additional security, multi-factor authentication should be incorporated when accessing core banking software. By necessitating multiple authentication factors, including passwords, biometrics, or security tokens, banks and PayTechs can accurately verify user identities, thereby reducing the chances of unauthorized access.

Another crucial part of a comprehensive security strategy is the adoption of Intrusion Detection and Prevention Systems (IDPS). These tools facilitate the monitoring and detection of suspicious activities within the network infrastructure and access to bank compliance software. By analyzing network traffic and identifying potential threats, IDPS solutions can actively respond to or block malevolent activities, thereby preempting unauthorized access attempts and potential data breaches.

Financial institutions should also commit to regular security audits and penetration testing. This practice helps to assess the robustness of core banking software, customer-facing applications, and other systems, and identify potential vulnerabilities. By simulating real-world attack scenarios, these tests can uncover weaknesses in security measures, enabling proactive remediation before cybercriminals can exploit them.

Lastly, the employment of Data Loss Prevention (DLP) solutions can help avert the unauthorized disclosure or loss of sensitive payment data. These tools scrutinize data usage, identify patterns in sensitive data, and enforce policies to prevent data leaks or unauthorized transfers. DLP solutions can also provide encryption, access controls, and activity monitoring, further enhancing data protection.

Embedded onboarding and CDD within the core banking software

In the rapidly evolving landscape of banking technology, flawless digital onboarding has emerged as a critical component of modern core banking software. With the growing demand for convenient and secure customer experiences, financial institutions are leveraging mobile apps and web forms to streamline the onboarding process. If you haven’t yet understood why the core banking software is the backbone of the bank compliance software, you will understand it now.

Digital onboarding via mobile apps or web forms has become the norm for customer acquisition. To ensure a smooth and secure onboarding experience, many core banking software vendors are developing their proprietary technology or integrating biometric identification solutions into their platforms. By incorporating biometric authentication, such as facial recognition, banks and PayTechs can enhance the security and convenience of user identification.

While the integration of biometric identification is beneficial, there are certain challenges that arise when accessing comprehensive reports related to identification results. In many cases, PayTech’s employees are required to log in separately to the biometric identification provider’s portal to obtain a full report containing biometric identification results, AML (Anti-Money Laundering), CTF (Counter-Terrorist Financing), PEP (Politically Exposed Persons), adverse media and sanctions screening results. This disjointed process can be inconvenient and time-consuming for compliance officers who need to cross-reference the data with the core banking software.

To optimise compliance procedures, it is crucial for bank compliance software to offer seamless access to biometric identification and screening results. This can be achieved through two key methods:

- API Integration: Bank compliance software should facilitate direct API integration with biometric identification providers. By leveraging APIs, PSP users can retrieve the necessary identification and compliance data without the need to navigate multiple portals. This streamlined approach allows for real-time access to up-to-date reports within the core banking software interface.

- Internal Data Storage: Alternatively, compliance data, including biometric identification and screening results, can be securely stored within the core banking software. This approach ensures that all relevant information is readily available for compliance officers without the need for external logins. By storing the data in an acceptable file format, such as PDF, the core system can act as a comprehensive repository of compliance-related information, thus acting as bank compliance software.

Bank compliance software unlocks a plethora of benefits through its seamless integration of biometric identification and compliance data. It gifts compliance officers with enhanced efficiency, eliminating the need for multiple logins and the manual cross-referencing of data. The amalgamation of compliance data into the core banking software streamlines identification and verification, propelling faster, more effective decision-making.

In the realm of regulatory compliance, the software truly shines. Providing real-time access to comprehensive compliance reports ensures that PayTechs can meet regulatory demands efficiently. Compliance officers, equipped with readily available and necessary data, can conduct in-depth due diligence, carry out precise risk assessments, and pinpoint potential issues with heightened accuracy.

More than just a tool for regulatory compliance, the software also enhances the customer experience. The streamlined onboarding process reduces friction during the identification and verification stages, offering customers a smoother journey. This refinement in process not only increases customer satisfaction but also promotes the development of long-term, beneficial relationships.

AML/CTF functionality of the bank compliance software

In the realm of financial services, Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) are crucial areas that require robust measures to prevent illicit activities. Reliable bank compliance software plays a pivotal role in ensuring AML and CTF compliance. Let’s explore the essential functions and integrations that a comprehensive core banking software should possess to effectively combat financial crimes.

When considering core banking software functionality, it’s imperative to integrate comprehensive anti-money laundering (AML) and counter-terrorism financing (CTF) features. The software should have the capability to work synergistically with external databases, essential for accessing information relating to arrests, warrants, sentences, or negative publicity. This information plays a crucial role in flagging potential risks. Below are the primary features a competent core banking software should incorporate:

- The software should possess an in-built onboarding questionnaire. This questionnaire is pivotal in calculating the initial risk score for customers. By collating vital details, such as the customer’s occupation, business type, and partners, the software can develop an accurate initial risk assessment. This initial assessment then acts as a guide for tailoring the compliance pathway for each customer.

- It is also essential for the software to establish initial payment limits, based on transaction volume and frequency, during the onboarding process. This feature will help add a layer of protection against suspicious activities by aligning payment limits with the customer’s risk profile.

- The software should also maintain a system for tracking the expiration of identification documents, a key factor in upholding the accuracy of customer due diligence information. It should be equipped to send automated reminders to the banking or PayTech staff when these documents near their expiration, thereby ensuring constant regulatory compliance.

- Continuous monitoring and periodic reviews of customer accounts should be inherent capabilities of the software. These reviews, essential in combating financial crimes, should be conducted based on the customer’s risk profile. For instance, low-risk customers may undergo biennial reviews, medium-risk customers could be reviewed annually, and high-risk customers might need reviews every six months. A software designed to implement these risk-based reviews will significantly enhance detection of potential suspicious activities.

- Finally, each customer transaction should undergo real-time AML and CTF checks against relevant databases. The software should include this verification process, utilizing external providers’ adverse media feeds to bolster its ability to flag potentially risky transactions. This real-time check capability is crucial for the swift identification and mitigation of suspicious activities.

Incorporating a resilient bank compliance software equipped with built-in AML and CTF measures and supplemented by external database integrations can bring forth a multitude of advantages.

Firstly, this type of software can boost compliance significantly. Its extensive functionalities empower banks and payment service providers (PSPs) to satisfy AML and CTF regulatory demands with remarkable efficiency and precision. By utilizing automated processes and real-time verifications, the software drastically reduces the risk of non-compliance, thus safeguarding the integrity and reputation of the institution.

Secondly, the software aids in mitigating risks. It does so by facilitating risk-based reviews and transaction inspections, allowing banks and PayTechs to proactively spot potential instances of financial crimes and diminish the associated risks. The software’s advanced algorithms and external integrations aid in detecting suspicious activities, thereby allowing for timely interventions to prevent illicit transactions.

Lastly, the software boosts operational efficiency. It simplifies compliance processes, minimizing the manual effort required for AML and CTF checks. By automating critical tasks such as customer risk evaluation, transaction surveillance, and regular reviews, the software promotes operational efficiency. This, in turn, enables PSPs to effectively allocate resources and concentrate on strategic priorities, leading to a more streamlined and productive operation.

PEP and sanctions screening functionality of the bank compliance software

In the ever-evolving landscape of financial services, identifying politically exposed persons (PEPs) and screening customers against sanctions lists are critical tasks for banks and PayTechs to fulfil their AML, CTF, and financial crime prevention obligations. A comprehensive bank compliance software plays a vital role in ensuring accurate PEP screening and robust sanctions list integration. Let’s discuss the importance of reliable database integration and the benefits of built-in sanctions list screening within core banking systems.

Having an effective PEP screening in place is critical in order to identify individuals with potential political influence and the risks they pose. This process is typically outsourced by banks and PayTechs, but it’s equally crucial that the integration provided by the core banking software vendor is reliable and always up to date.

You’ll want a PEP database integration that consistently receives updates on a daily basis. These updates should come from PEP database provider representatives located in various jurisdictions worldwide. This helps to ensure the software is always working with the latest information, leading to more accurate identification of PEPs and minimization of potential compliance risks.

It’s also important to understand that not all PEP databases are created equal in terms of quality and coverage. Therefore, a thorough assessment of the data sources used by the integration is needed. By choosing a reliable provider that offers comprehensive coverage across the jurisdictions that matter to you, you can be confident in your software’s ability to effectively screen customers and detect any potential risks associated with PEPs.

Beyond PEP screening, another crucial aspect of financial crime prevention is the careful scrutiny of customers against sanctions lists. Many core banking software providers offer the option to integrate sanctions list screening. However, PSPs can also utilize open-source information and develop their solutions in-house. This move could unlock a few notable benefits.

One significant advantage is cost savings. By integrating sanctions list screening directly into the core banking system, banks and PSPs can lessen their dependence on external providers. This strategy could eliminate costs associated with integration and ongoing subscription fees, giving PSPs the flexibility to tailor their solutions according to their specific needs, all the while maintaining sanctions compliance.

Comprehensive transaction screening is another benefit that comes from integrating sanctions list screening. With this feature, every customer transaction and associated data points—like identities of remitters and beneficiaries—can be screened against both PEP databases and sanctions lists. This robust integration ensures seamless transaction screening, dramatically minimizing the risk of processing transactions with sanctioned entities.

Lastly, it’s essential that your bank compliance software can accurately match entities against sanctions lists. To that end, reliable software should feature robust transliteration capabilities. This functionality is necessary to accommodate variations in names and spellings, helping banks and PSPs to identify potential matches—even if the names are spelled differently. In doing so, PSPs can remain in compliance with their regulatory obligations.

Implementing reliable PEP screening and integrating sanctions list screening within the core banking software offers several benefits:

- By utilising comprehensive bank compliance software, banks and PayTechs can ensure adherence to AML, CTF, and financial crime prevention obligations. Reliable database integrations and built-in screening functionalities minimise the risk of inadvertently dealing with high-risk individuals or entities.

- Accurate PEP screening and sanctions list integration empower banks and PayTechs to identify and mitigate regulatory risks associated with money laundering, terrorism financing, and other financial crimes. Real-time screening enables proactive detection and prevention of illicit activities, safeguarding the company’s reputation and regulatory standing.

- Integrating PEP and sanctions list screening directly within the core banking software streamlines compliance processes. Automated checks and reliable database integrations enhance operational efficiency, enabling banks and PayTechs to allocate resources effectively and focus on providing excellent customer service.

Risk scoring and transaction monitoring functionality of the bank compliance software

In today’s financial landscape, the risk-based approach plays a crucial role in combating money laundering, terrorist financing, and other financial crimes. For banks and PayTechs, implementing effective risk assessments and evaluations is vital in establishing robust policies and procedures to mitigate identified risks. Let’s explore the significance of risk scoring, factors to consider in risk assessments, and the importance of incorporating this approach into bank compliance software.

The risk-based approach entails evaluating the risk associated with each customer and transaction within a bank’s AML/CTF regime. This assessment helps determine specific policies and procedures that effectively address the identified risks. Every customer and transaction carries a varying degree of risk, influenced by factors such as distribution channels, geographical considerations, product or service type, customer classification, transaction value, velocity, and other factors.

Surprisingly, many modern core banking software and some legacy core payment systems offered to start-up PayTechs overlook the essential requirement of a risk-based approach. Despite being a legal requirement in Europe and highlighted by the Financial Action Task Force (FATF) as a centerpiece of effective AML/CTF compliance programs, many vendors often fail to provide this critical module within their core banking solutions. As a result, banks and PayTechs are left with two options: developing their own solution or outsourcing it from another provider.

The absence of a risk-based module in core banking software creates various challenges for banks and PayTechs:

- Developing an in-house solution or outsourcing adds significant expenses to running the business, affecting PayTech’s bottom line. Budget allocation for additional software or service providers strains financial resources, potentially hampering growth and innovation.

- The need to seek alternative solutions disrupts the timely launch of new products and services. Banks and PayTechs must invest additional time and effort into integrating risk-based functionalities, causing delays that impact market competitiveness and revenue generation.

- The absence of a built-in risk-based module and reliance on the third-party integration can result in loopholes in data protection, particularly concerning safeguarding sensitive payment data. This leaves PSPs exposed to potential breaches and compromises customer trust.

The integration of risk-based modules within bank compliance software offers numerous advantages to banks and PayTechs, extending well beyond mere regulatory compliance.

A sophisticated bank compliance software, featuring a risk-based approach, ensures banks and PayTechs meet AML/CTF regulations effectively. This alignment with legal requirements and industry standards signals their commitment to the proactive prevention of financial crimes.

Furthermore, incorporating risk scoring functionalities allows banks and PayTechs to gauge and control risks linked to every customer and transaction accurately. This capability equips these institutions with the tools necessary to devise and implement measures, policies, and procedures that significantly mitigate identified risks, thereby enhancing their security posture.

The inclusion of risk-based modules into core banking software also paves the way for more streamlined compliance processes for banks and PayTechs. The automation of risk assessments and evaluations eliminates excessive manual labour, bolsters efficiency, and optimises resource distribution within the organisation. Ultimately, these advances help to create an environment where strategic objectives can be pursued more effectively.

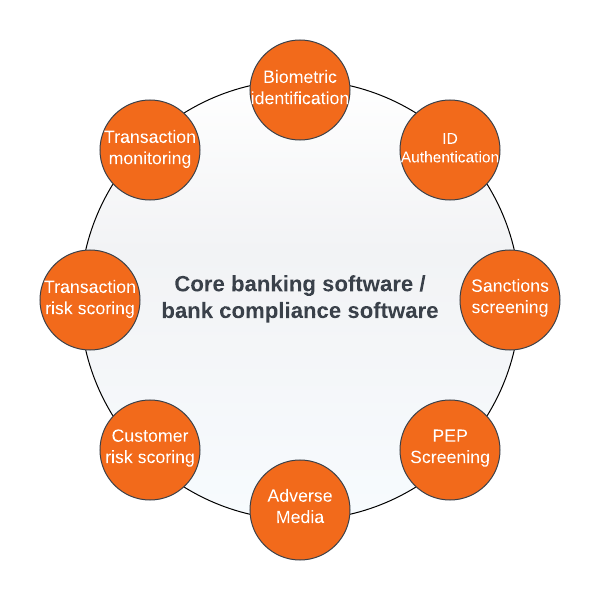

In summary bank compliance softwaree should have 8 key features as are shown in the illustration below:

How Baseella can help

A good cloud-based SaaS core banking software technology provider like Baseella offers several advantages over developing your own solution. Firstly, it significantly reduces time to market, allowing PayTech institutions to quickly launch and scale their services without the need for extensive development and infrastructure setup. Secondly, it eliminates the burden of maintaining and updating complex software, as Baseella takes care of regular updates, security patches, and system enhancements. Thirdly, it offers cost savings by eliminating the need for significant upfront investments in infrastructure, development resources, and ongoing maintenance. Additionally, Baseella provides access to advanced features, such as API integrations, automation capabilities, and regulatory compliance tools, allowing financial institutions to stay competitive and meet evolving customer demands. Lastly, the scalability and flexibility of a cloud-based core banking software technology enable seamless expansion and integration with other systems, ensuring adaptability to changing business needs and technological advancements.