Ultimate core banking software to launch your PayTech

start-up in 5 days

Welcome to Baseella, the ultimate core banking software and ecosystem of customer-facing apps designed to empower payment and electronic money institutions. Our comprehensive solution is tailor-made to address all the operational challenges faced by PayTech firms, including financial crime prevention, regulatory compliance, management and financial reporting. With Baseella, startups can swiftly launch their services and scale their business without the burden of multi-million euro investments in core banking software.

Suitable for different FinTech companies

Electronic Money Institutions

Providing electronic money issuance and distribution, electronic wallets, current accounts, prepaid and debit cards, currency exchange

Payment Institutions

Providing variety of services from payment accounts, money transfers, currency exchange, to merchant acquiring settlements and payouts

Neobanks

Providing primarily transactional banking services, such as current, checking and savings accounts, debit and credit cards, credit transfers and currency exchange

Money Service Businesses

Providing financial services such as cash collection, currency exchange, money transfers, remittance processing, check cashing, and facilitating payments

On/Off Ramp Providers

Providing seamless cryptocurrency and fiat conversion services, such as facilitating deposits and withdrawals between crypto and traditional currencies

Stablecoin Issuers

Providing issuance and management of stablecoins, such as facilitating the minting and redemption of tokens pegged to fiat currencies and ensuring price stability through reserves

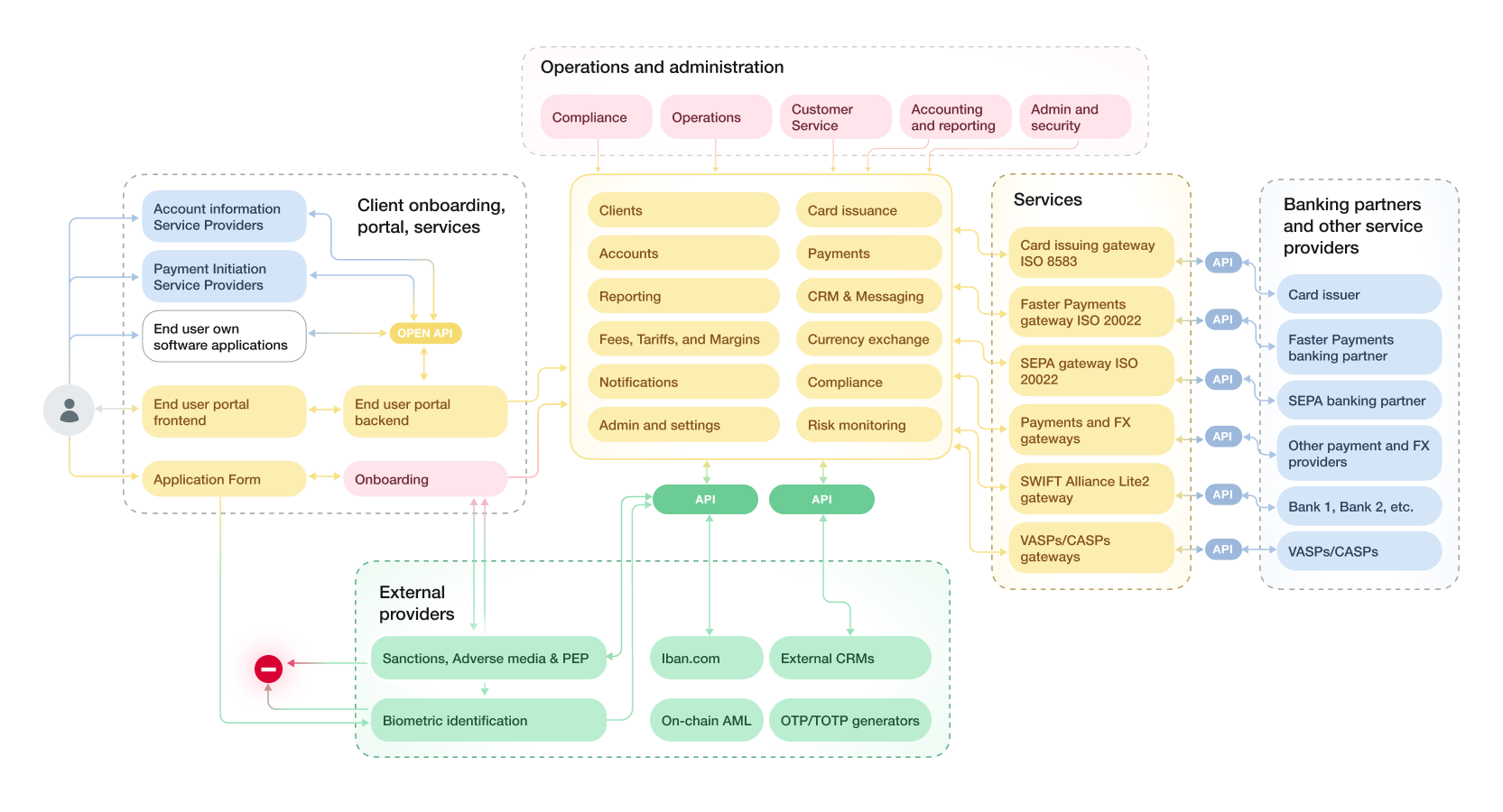

Architecture that enables growth

Baseella’s microservices-based architecture, each with its own database, coupled with intra-communication, deployment, and container orchestration platform Docker + Kubernetes, provides maximum autonomy and flexibility that allows PayTechs to be very efficient in how they are building their customer journey, products and services.

Key design principles

Microservices architecture

Microservices architecture that follows the principle of breaking down a monolithic application into smaller, independent services

Modern technology

Entire technology stack is based on the open-source solutions with rich ecosystem and big community of developers

Powerfull API + Graph QL

API that conforms to the constraints of REST architecture, Federated GraphQL platform that power the API layers

Cloud-first

Hosted on AWS, Google Cloud, Azure, or any other cloud platform that supports Kubernetes

Accessible on any device

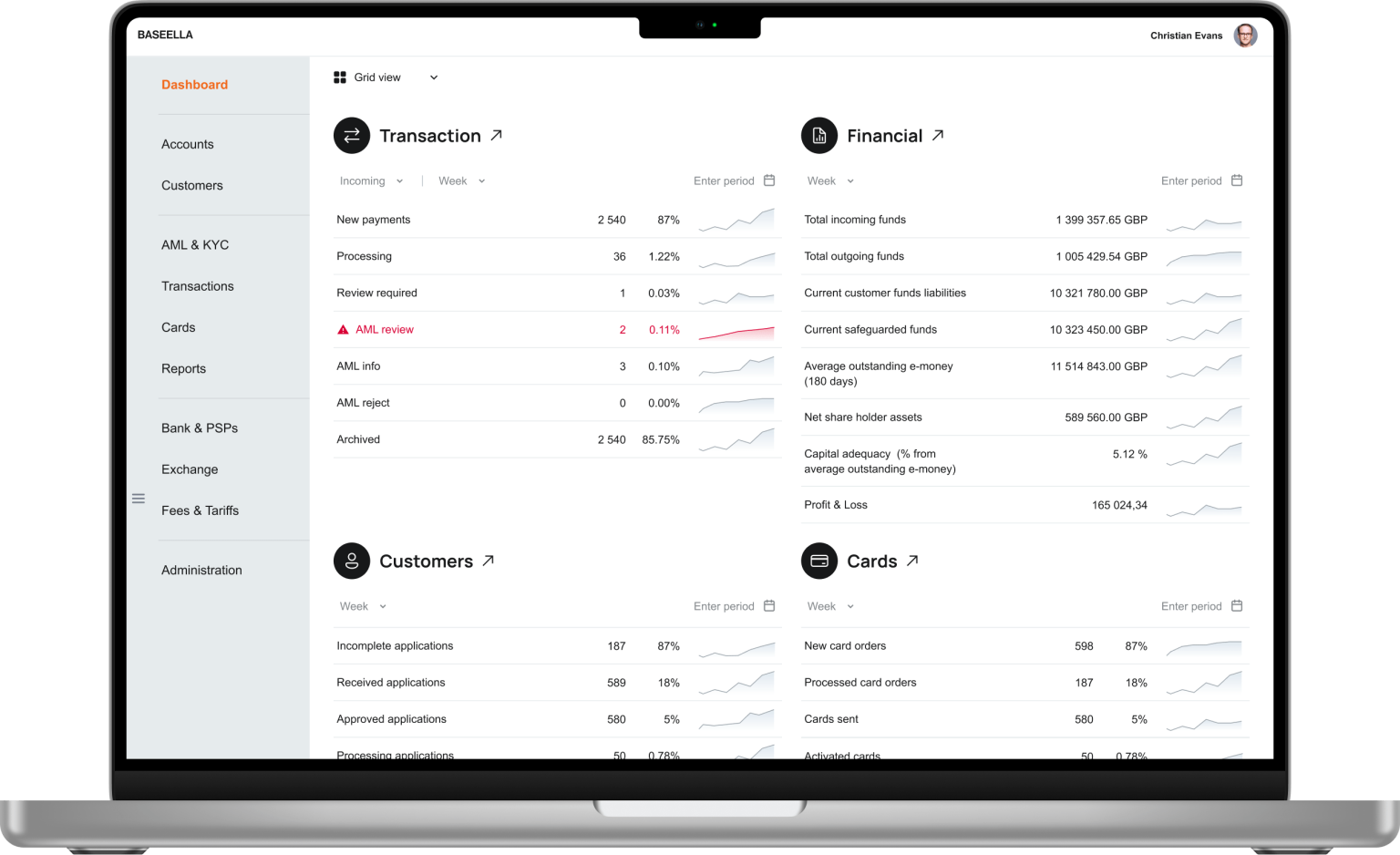

Baseella interface is accessible from any web browser, so there is no need to install any native applications, drivers, and other software like Microsoft Office. The PayTech operations team can effectively carry out their tasks using any type of computer or tablet with any web browser.

Key Features

At Baseella, we understand the unique needs of the PayTech industry, and our cutting-edge core banking software is built to exceed your expectations. Our out-of-the-box solution provides a seamless experience, enabling you to streamline your operations and focus on what matters most – delivering exceptional payment services to your customers.

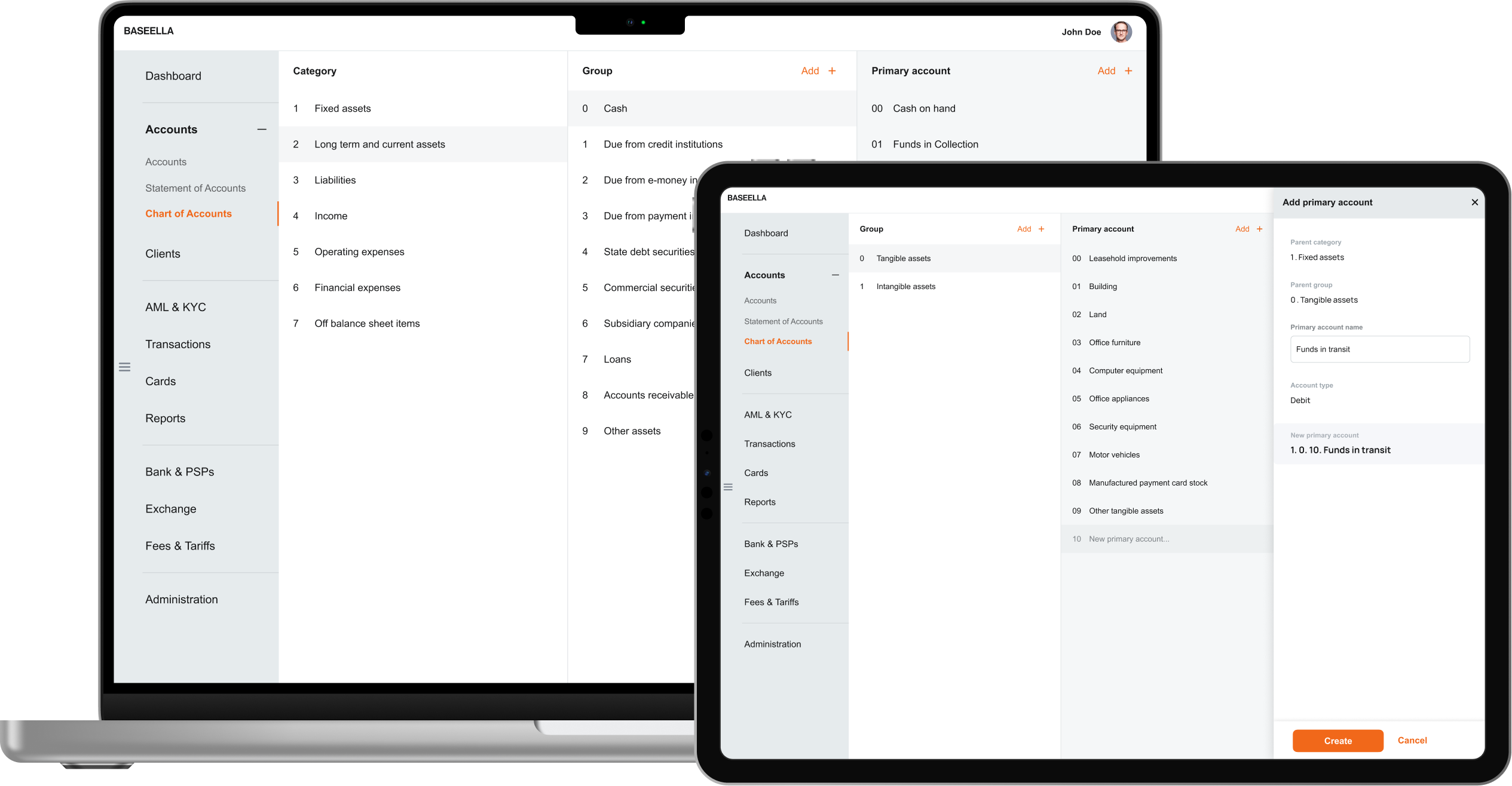

General ledger based

Baseella is designed as an accounting system with fully customisable chart of account at its heart. There is no need to use any accounting software in your operations

Comprehensive Reporting

Since Baseella supports all accounting transactions, management, financial, and regulatory reports can be produced in a few seconds

Customer applications

Baseella is supplied with the white-labeled customer application app (with integrated biometirc identification), internet bank, iOS and Android mobile applications

Compliance suite

You are in full control of risks with our compliance suite and integrated nature of AML/CTF, PEP, sanctions, adverse media, customer and transaction monitoring

Risk scoring

Baseella boasts proprietory customer and transactions risk scoring and fully configurable transacton monitoring module which reduces compliance risks and costs

Customer Relationship Management

Baseella comes with an embedded CRM and allows you to interact with your clients directly through the backend system

We know the pain points

Still not sure whether Baseella is what you need? We know the main problems facing PayTechs and how to solve them. Below is an overview of the main pain points that we strived to solve while developing our ultimate core banking software.

Most newly developed core banking solutions have no intra-company transactions recording, accounting and financial reporting resulting in a need to keep a separate set of books in the accounting software, absence and/or delays of reliable financial reporting.

Basella was created as an accounting system first of all. It is built around a fully-fledged customisable chart of accounts functionality, just like any comprehensive core banking system but without the drawbacks of legacy technology.

Every transaction is recorded as a double entry in assets and liabilities. All accounts are multicurrency, and any account, balance sheet, profit(loss), cash flow, or any other report or statement is revalued automatically to reflect the correct financial position in the functional currency of the company.

As a result, the PayTech startup does not need to maintain any separate accounting software or even have any accountants in its team. Management has an on-demand 360-degree view of the financial performance of the company.

Most newly developed core banking solutions have no management, financial, and/or regulatory reporting, as they are not designed with a chart of accounts at their core. In most cases, data must be harvested manually and inserted into reports, resulting in reporting teams performing time-consuming tasks manually on a daily basis.

Being a fully-fledged accounting system, Baseella can produce any management or financial report needed at the press of a button. Moreover, new types of reports ones can easily be configured if more than pre-configured reports are required.

In addition to the standard financial reports such as balance sheet, profit(loss), and cash flow, management has access to the PSP's bank accounts reconciliation report, safeguarding reconciliation report, capital adequacy report, new customer application processing report, payments statistical data report, open currency position report, customer churn, customer profitability report, customer concentration report, product/service profitability report, and others.

Since Baseella was created by regulatory compliance professionals, regulatory reporting is a breeze with our core banking software. Management can populate regulatory reports, such as FCA's REP017 (Payments Fraud Report), export data to the desired format, or upload it to the regulator's portal.

Most newly developed core banking solutions have no functionality or reporting related to the safeguarded customer's funds reconciliation against outstanding issued e-money or payment account balances.

Since safeguarding reconciliation and withdrawal of excess funds from safeguarding bank accounts or paying in the shortage of funds to the safeguarding bank account is a critical regulatory requirement and a daily exercise, PSPs must automate it.

Imagine, for a moment, if your core banking software is not functioning as an accounting system – safeguarding reconciliation will be a nightmare and require manual calculations using data from 3-4 different systems and could take hours to complete.

Baseella’s safeguarding reconciliation report is produced within seconds, and the only thing remaining is to send a bank order to withdraw excess funds or pay in the shortage.

Most newly developed core banking solutions have no ongoing and future regulatory capital adequacy calculation functionality.

Before our founders came up with the idea to develop Baseella, they were stunned by the lack of ongoing capital adequacy calculation functionality in all newly developed core banking solutions they have seen.

Needless to say that Baseella has an ongoing capital adequacy calculation report which supports method D for electronic money institutions and methods A, B, and C for payment institutions, which can be generated within seconds.

Thanks to the comprehensive suite of financial reports, with Baseella, PSPs can also produce an AI-driven capital adequacy forecast that considers PSP's financial performance, client base growth and churn, outstanding e-money balances dynamics, payments volume, and other factors to remain compliant and plan for the near future.

Most legacy and newly developed core banking solutions have no automated customer risk scoring: initial (upon onboarding) and ongoing (dynamically changing with time).

The risk-based approach is one of the regulatory compliance fundamentals of any PayTech. Risk scoring of the customers is an essential part of that approach and is a new normality for any PayTech business with ambitious growth plans.

Surprisingly, only a few newly developed core banking solutions have a customer risk scoring system and such functionality can be rarely found in the legacy core banking solutions. Most developers are suggesting integrations with third-party providers, which increase the operating costs of the PayTech startups and open Pandora’s box in respect of GDPR compliance, as critical personally identifiable data is shared with a third party.

Baseella addresses this problem by offering comprehensive customer risk scoring functionality. The customer’s risk score is set initially based on the PSP risk appetite, policies and procedures and updated dynamically depending on the customer's transaction risk pattern and behaviour.

Most newly developed core banking solutions have no transaction risk scoring or transaction monitoring functionality.

The newly developed core banking solutions do not usually provide transaction risk scoring and transaction minoring, and PayTechs are suggested to outsource such services from a third party.

Apart from increasing the operational costs of the PayTech startup, it creates a sensitive payment data protection issue, as comprehensive transaction data is shared with a third party. Therefore, PayTech has to ensure that such a third party protects sensitive payment data as a PayTech would, which is mission impossible.

Baseella has developed the transaction risk scoring functionality based on the geographical, product, delivery channel, the value of the transaction, and customer risk score factors, as well as transaction monitoring rules that can be easily configured to the specific PayTech requirements. As a result, investigating potentially suspicious transactions is fully automated, leading to effective and lean operations.

Most newly developed core banking solutions have no built-in customer service, sales, and communication systems. The absence of intra-company communication systems results in complex operations management and the need to use third-party messengers.

Baseella addresses these problems by offering fully-fledged customer service, sales, and communication functionality. Customers' notifications can be delivered via SMS, e-mail, in-app or browser message, or push notification.

Sales and marketing notifications can be designed based on the type of clients, location, spending patterns, and turnover, thus creating an effective marketing campaign that will not be too intrusive and will target the audience with precision.

One of the key operational features of Baseella is a system of internal notifications within the core payment software. The purpose of such a system is to notify core system operators of specific actions they need to undertake. For example, notification of the failed card payment should reach a customer services specialist who can investigate the cause of the problem and proactively approach the customer with a resolution or refer the case to a supervisor via internal notification.

Most newly developed core banking solutions have no fully integrated customer onboarding application, biometric identification, ID authentication, AML/CTF, PEP, adverse media, and sanction screening, which makes customer onboarding cumbersome.

Most PayTech startups rely on third-party solutions for the customer onboarding process. However, in most instances, such solutions are not fully integrated with PayTech core banking software, resulting in the necessity to switch between different user portals of various providers during customer onboarding.

Baseella comes standard with a complete customer onboarding toolset, from the application form (web and app), to the native integration with the best biometric identification and ID authentication providers. Therefore, there is no need to jump between Baseella interface and the provider's interface; an entire onboarding process is managed from Baseella interface.

Baseella has built-in sanctions lists published by the HM Treasury OFSI, European Union, OFAC and UN. In addition, any other sanction lists can be easily integrated. If there is a need to use the third-party PEP and negative media provider, such integrations with the best third-party providers are readily available. Coupled with Baseella's customer risk scoring function, our clients are equipped with the best-in-class customer onboarding suite.

Most newly developed core banking solutions have no comprehensive two-factor strong customer authentication solutions that are applied proportionally to the transaction risk to reduce inconvenience for the customers.

Since Basella has a fully-fledged transaction scoring system, SCA requests and push notifications can be easily orchestrated based on the transactions' risk profiles while maintaining the highest standards of financial crime prevention.

Customers of PayTech startup that is using Basella can choose between different SCA methods and notification delivery channels to suit their preferences. All SCA methods support dynamic linking to the amount of the payment transaction and the payee.

Notifications of the executed transaction and unusual accounts access activities are optional and are an excellent method for preventing financial crime and hacking of the e-wallet/payment accounts.

Most newly developed core banking solutions are not supporting BaaS, or in other words embedded payments functionality.

One of the rapidly developing PayTech segments is Banking-as-a-Services provision, where PayTech company enables other companies to embed electronic money and payments into their offering, by appointing such companies as distributors or agents.

Baseella supports BaaS (or embedded payments) business model by enabling distributors or agents to seamlessly integrate electronic money and payments of PayTech via powerfull RESTful API with GraphQL Federation.

If the distributor or agent is providing electronic money or payment services as their primary service, PayTech startup can sublicense Baseella (at additional annual fee) and provide such distributor or agent with Baseella core, which seamlessly integrates into Baseella core of PayTech company. It takes usually 2 to 3 years to launch BaaS business, with Baseella, you can do it in 5 days.

Most newly developed core banking software solutions lack crypto functionality.

Baseella supports modern technologies and offers native integration for exchanging crypto-to-fiat and vice versa. Our solution is ideal for those looking to create their own gateway bridging traditional finance and crypto assets.

Even if you prefer to integrate your own crypto exchange functionality, this can be achieved seamlessly with the help of our robust GraphQL API. Meanwhile, Baseella will handle all fiat-related reporting and serve as the overall backbone of your operations.

Financial benefits of using Baseella

Apart from fully integrated operations management, comprehensive functionality, suite of compliance tools, by using Bassella our clients will benefit financially

Save €400,000

per annum if you are using a legacy core banking system or developing and maintaining your own

Save €80,000

per annum on third party financial crime, risk scoring, and transaction monitoring software

Save €70,000

per annum on accountant and reporting specialist salaries - there is no need for them

Reduce by 30%

your operations, customer services, and compliance team size