For PayTech firms, the choice of a core banking solution is no longer a simple question of technology. It’s a strategic decision that defines how fast they can scale, how effectively they can meet regulatory requirements, and how much control they retain over their own future. Should a firm build its own platform from the ground up, buy a ready-made system, or pursue a hybrid path that blends both approaches?

And, just as importantly, should the core itself be designed as a lean transaction engine or as a full-stack platform with integrated services? The answers shape not only day-to-day operations but also long-term competitiveness in an increasingly regulated and innovation-driven market. In this article, we’ll analyse and answer 14 questions that will help to shape your understanding of how you should choose the best core banking solution.

What is a core banking solution for a PayTech firm, and why does the definition matter?

A core banking solution, when viewed through the lens of a PayTech firm, is not simply a transaction processor. It is the architectural spine of the organisation, the point where compliance, customer experience, and operational efficiency converge. Yet in practice, the industry uses the same phrase to describe two very different approaches.

The first is a stripped-down interpretation. Here, the core banking solution is little more than a general ledger and payments engine. It does what the name suggests, it has a ledger of accounts, posts debits and credits, maintains balances, processes payments, and reconciles transactions. Everything else, including onboarding, KYC, AML, fraud monitoring, and reconciliation workflows, is handled by adjacent systems, stitched together with integrations and APIs. This approach keeps the core clean and narrowly defined, but it places the burden of orchestration and scalability on the PayTech itself.

The second approach is much more ambitious. While still grounded in ledger and payments, it expands outward into what is effectively a full-stack platform, almost ERP-like in nature. In this model, the core banking solution encompasses onboarding, digital identity verification, sanctions and PEP screening, real-time transaction monitoring, accounting, reporting, treasury, and even customer engagement layers. It collapses what might otherwise be a fragmented technology stack into a single, cohesive operating system for payment services. For simplicity, we continue to call it a core banking solution, but in substance, it is the full operational backbone of the PayTech enterprise.

For firms navigating licensing, compliance, and rapid growth, the difference between these two models is not academic. A lean core maximises flexibility but demands strong integration discipline. A full-stack core reduces system sprawl and accelerates time to market, but also requires a commitment to the vendor’s architecture and roadmap. This is why clarifying what kind of core banking solution one is actually talking about is a necessary first step before deciding whether to build or buy.

Which core banking solution is better for a PayTech, lean or full-stack?

A lean core banking solution excels when you want maximum design freedom and the ability to swap components as your product evolves. You keep the core ledger and payments engine focused, then assemble onboarding, KYC, AML, fraud, accounting, and engagement around it. This can deliver sharper differentiation, since you pick the exact tools that fit your risk models and customer journeys.

The catch is vendor spaghetti. Each additional provider brings its own APIs, data contracts, SLAs, upgrade cycles, and incident processes, so a release that touches three systems can turn into a month of coordination. You will mediate blame during outages, reconcile slightly different definitions of a transaction state, and maintain translation layers when versions drift. Over time, this creates operational drag, and governance becomes a full-time discipline rather than an afterthought.

Costs also shift in ways that are easy to underestimate. The license fees for individual components may look modest, but integration work, ongoing maintenance, and duplicated capabilities add up. You pay for multiple audit frameworks, multiple data pipelines, multiple observability stacks, and you absorb hidden charges like per API call pricing, data egress, premium support tiers, and compliance updates that must be rolled out across several vendors at once. Headcount grows around partner management, contract negotiation, reconciliation, and incident response. If your transaction volume rises, per transaction pricing can outpace what a more integrated model would have cost at the same scale.

A full-stack core banking solution takes a different path. It packages ledger, onboarding, identity, payment processing, customer-facing front-end and mobile apps, monitoring, and reporting under one architecture with one data model, which cuts the friction that normally appears at the seams. Time to market is usually faster, regulatory change is easier to roll out consistently, and your operational posture is simpler, one roadmap, one SLA, one incident process. The trade is less freedom to redesign internals, and a real commitment to the vendor’s release cadence. Your cost profile is more predictable, although you may pay for modules you do not immediately use, and your exit cost rises if you later want to unbundle.

Which is better depends on where you are and how you plan to grow. If you are early, pursuing licenses, or entering new jurisdictions with a lean team, a full-stack core banking solution will feel like a force multiplier because it reduces seams you would otherwise have to manage. If you are VC-funded, product-led with seasoned platform engineers, clear differentiation in risk or reconciliation, and a tolerance for complex vendor governance, a lean core can work, but only if you budget for integration depth, partner management, and the real total cost of ownership rather than the headline licenses.

In practice, many PayTech firms start by integrating to get live quickly, then selectively unbundle pieces once scale and product clarity justify the extra complexity.

Which core banking solution approach have leading PayTech players like Monzo, Revolut, and Wise chosen, and what does that reveal about their strategies?

Monzo, Revolut, and Wise each made very deliberate choices about their core banking architecture, and those choices reflect their growth strategies as well as the regulatory contexts in which they operate.

Monzo built its own core banking solution from scratch, opting for a lean but deeply customised system. The motivation was control: by owning the ledger and transaction engine, Monzo could innovate quickly on product features, tailor its technology to UK regulatory requirements, and avoid dependency on a third-party vendor. The cost was high and the effort immense, but it gave Monzo flexibility in shaping the customer experience around real-time notifications, spending insights, and later the expansion into current accounts and lending, and eventually turned this into a competitive advantage.

Revolut took a different path. In its early years, it relied heavily on a patchwork of vendor systems and banking partners, effectively operating on a lean core with integrations stitched together. Over time, it has been building more in-house capabilities, but the legacy of vendor spaghetti has been visible in slower launches of regulated products and the challenges of scaling across so many jurisdictions. Revolut has since invested heavily in building its own full-stack platform, though the transition has been gradual.

Wise pursued yet another model. From the beginning, it focused on building a highly specialised payments and FX engine, its own ledger and treasury system, because that was the differentiator. But instead of trying to build everything, Wise integrated external providers for peripheral needs like customer onboarding and compliance. In effect, it created a hybrid approach: a lean, custom-built core around cross-border payments, surrounded by selected vendor systems where Wise saw no strategic advantage in reinventing the wheel.

Taken together, these examples illustrate that there is no one right answer. Monzo leaned toward building its own core for control and differentiation. Revolut initially outsourced to move fast, then began to insource as scale and regulation demanded stability. Wise carved out its own engine where it mattered most and left the rest to carefully chosen partners. Each approach reflects not just a technical preference but a strategic alignment with their business models and regulatory obligations.

Evaluating Build vs Buy: Key Factors for PayTech Firms Choosing a Core Banking Solution

What factors should a PayTech firm carefully evaluate when deciding whether to build or buy a core banking solution, and how does the choice between SaaS and perpetual license models influence that decision?

When deciding whether to build or buy a core banking solution, and whether to choose a SaaS subscription or a perpetual license, PayTech firms should evaluate the following factors:

- Team knowledge and hiring capacity: do you have engineers who have built and operated a banking-grade ledger, real time payments, and high-availability systems, plus SRE, security, and data teams who can run them 24/7. Can you hire for KYC, AML, and regulatory engineering. If not, buying a core banking solution, SaaS or licensed, reduces execution risk.

- Time to market: building from scratch stretches timelines, while SaaS cores can often go live within months. If speed is critical for licensing or market entry, SaaS has the edge.

- Total cost of ownership: building requires heavy upfront investment in engineering and compliance, but costs level out at scale. SaaS turns costs into predictable operating expenses, which helps early but may become expensive at high volume. Perpetual licenses involve a large upfront spend plus maintenance fees, making sense only if long-term scale and internal capabilities are strong.

- Control and flexibility: a custom build gives you freedom over features and integrations, but also leaves you responsible for uptime, resilience, and regulatory change. SaaS and licensed solutions trade flexibility for stability, updates, and guaranteed compliance support.

- Vendor strategy and lock-in: SaaS ties you closely to the vendor’s roadmap and update cycle, while perpetual licensing gives more autonomy but pushes upgrade responsibility onto your team. In both cases, vendor stability and alignment with your future needs are essential.

- Scalability and differentiation: if your competitive edge lies in unique settlement logic or product features, building may be unavoidable. If your focus is scale, distribution, and customer experience, buying an integrated solution allows you to avoid reinventing infrastructure.

Are the evaluation factors equally important when assessing both lean and full-stack core banking solutions?

To answer simply – yes, the evaluation factors differ depending on whether you are considering a lean core or a full-stack core banking solution. With a lean core, flexibility is the central advantage. You can hand-pick best-in-class providers for onboarding, compliance, fraud detection, and customer engagement. The trade-off is integration complexity, often called vendor spaghetti, and higher long-term costs as you accumulate multiple licenses, contracts, and maintenance obligations. This approach also places a premium on your in-house expertise: you need engineers and product teams capable of stitching the system together, maintaining resilience, and ensuring compliance across several moving parts.

A full-stack core shifts the balance. Here, evaluation focuses less on integration and more on vendor alignment. Time to market is faster, the cost profile is predictable, and operational overhead is lower because the vendor takes responsibility for uptime, compliance updates, and system coherence. The downsides are reduced flexibility, some degree of lock-in to the vendor’s roadmap, and fewer opportunities for deep product differentiation within the core itself.

In short, when evaluating a lean core- you measure your team’s ability to manage complexity, vendor sprawl, and cost creep. When evaluating a full-stack core- you measure your willingness to accept vendor constraints in exchange for stability, speed, and efficiency.

How should PayTechs evaluate team knowledge and hiring capacity when choosing a core banking solution?

When looking at the build versus buy decision through the lens of team knowledge and hiring capacity, the trade-offs become especially clear. Building a core banking solution demands rare expertise. You need engineers who can design and operate banking-grade ledgers, handle real-time payments, and maintain high-availability distributed systems. On top of that comes the need for security specialists, SRE teams, and regulatory engineers who understand the intricacies of KYC, AML, reporting, and audits. Recruiting and retaining this talent is expensive, and the knowledge has to be kept current as regulations and technology evolve. Building is therefore not a one-off project but a long-term organisational commitment to developing and maintaining specialised capabilities.

Buying a core banking solution changes the equation. The vendor provides much of the domain expertise, certifications, and compliance updates, which reduces the need for highly specialised hires inside your organisation. Your team can then focus on integration, product features, and customer experience rather than rebuilding infrastructure. Hiring pressure is lighter, but dependency on the vendor becomes higher, and your ability to innovate at the deepest levels of the system is more constrained.

In practice, the question of team knowledge and hiring capacity is less about technical possibility and more about organisational identity. A firm that builds its own core is signalling that it wants to become a technology company as much as a financial one, with the intellectual property and institutional expertise that this entails. A firm that buys is making a different but equally rational choice, treating the core as infrastructure and concentrating its scarce talent on differentiation at the edge. Neither path is inherently superior, but each sets the trajectory for how the company will need to recruit, retain, and cultivate expertise over the long run.

What impact does the build vs. buy decision have on time to market for a core banking solution?

Time to market is often the single most decisive factor in choosing whether to build or buy a core banking solution. Building in-house inevitably extends timelines. Even with a seasoned engineering team, designing and deploying a banking-grade ledger, compliance workflows, and resilient infrastructure can take years. Delays are common because regulatory approvals, audits, and unforeseen integration challenges rarely follow a predictable schedule. For a PayTech, this means that entering a new market, obtaining a license, or launching a new product may take far longer than the commercial opportunity window allows.

Buying, particularly under a SaaS model, compresses these timelines dramatically. Vendors of the full-stack core banking solutions offer pre-built modules for onboarding, AML, reconciliation, and reporting, already tested under regulatory scrutiny. A PayTech can often move from contract to live deployment in months rather than years. This acceleration is especially valuable when investors expect rapid scaling or when a regulatory deadline is fixed. Perpetual license models are slower than SaaS because implementation and customisation demand more effort, but they still outpace a full in-house build.

The consequence is that time to market is not just a technical detail but a strategic choice. If a PayTech’s differentiation depends on being first to launch or quickly capturing market share, buying a core banking solution usually aligns best. If the firm has the capital, patience, and ambition to create a proprietary platform as a long-term asset, then it can afford the extended timeline of building. In this sense, time to market is both a constraint and a signal of strategic intent.

In what ways does total cost of ownership influence the choice of a core banking solution?

Total cost of ownership goes well beyond the headline price tag of licenses or the initial development budget. When building, the upfront costs are substantial: engineering teams, security specialists, regulatory experts, and infrastructure must all be funded before a single transaction is processed. Once live, costs shift to ongoing maintenance, compliance updates, audits, and continuous scaling. The advantage is that marginal costs per transaction can fall over time, making building attractive for firms that expect very high volumes and want to avoid per-transaction fees.

Buying changes the profile. SaaS models spread the expense into predictable operating costs, often charged per transaction, per account, or per customer. This can look efficient at early stages, since you avoid heavy capital expenditure, but it becomes progressively more expensive as scale grows. Perpetual license models sit in the middle: they require significant upfront investment plus annual maintenance and further development, but they can offer a flatter cost curve at scale compared to SaaS.

There are also hidden elements. Building demands larger teams, higher recruitment costs, and ongoing risk management, while buying can create lock-in to vendor pricing and contractual escalation clauses. Migration costs, exit penalties, and the expense of integrating or customising off-the-shelf systems all add to the real total.

For a PayTech, the decision is therefore not about which option is cheaper in absolute terms, but which cost structure aligns with its growth strategy and funding model. A venture-backed firm seeking rapid market share might prefer the variable costs of SaaS, trading long-term efficiency for speed. A firm with deep capital reserves and an ambition to run at a global scale might accept the upfront burn of building, knowing the marginal economics improve later. In either case, the total cost of ownership defines not just the budget line, but the financial trajectory of the entire business.

How do control and flexibility affect the decision to adopt a core banking solution?

Control and flexibility are often the hidden levers behind the build versus buy debate. Building your own core banking solution gives you authority over every layer of the system, from how the ledger records transactions to how compliance workflows are embedded. You decide the architecture, the release cadence, and the product roadmap. This level of control is invaluable if your strategy depends on innovation in areas such as reconciliation logic, treasury management, or regulatory reporting. It also means you can adapt quickly to new jurisdictions or regulatory changes without waiting for a vendor to prioritise them.

The cost of this control, however, is responsibility. Every compliance update, every audit requirement, and every performance bottleneck becomes yours to solve. Flexibility in architecture is matched by the obligation to continuously maintain, secure, and evolve the system, which demands a deep bench of specialised talent.

Buying, by contrast, shifts control to the vendor. SaaS platforms or licensed solutions come with predefined data models, compliance modules, and upgrade cycles. For many PayTechs this is not a weakness but a relief, because it guarantees regulatory alignment and stability. The trade-off is that innovation at the core is constrained. You adapt to the vendor’s roadmap, not the other way around, and negotiating custom features can be slow or expensive.

For a PayTech deciding between the two, the real question is whether control of the core is a source of competitive differentiation or simply a cost of doing business. If the core is where your uniqueness lies, building ensures freedom. If your differentiation is at the customer experience layer or in distribution, buying a stable, vendor-managed core may be the more rational path.

What role do vendor strategy and lock-in risk play in selecting a core banking solution?

When a PayTech buys a core banking solution, it inevitably aligns with the vendor’s strategy and roadmap. In a SaaS model, the cadence of updates, the way compliance features are rolled out, and even pricing adjustments are largely outside of your control. For many firms, this is a fair trade, because it means less time worrying about regulatory upgrades or infrastructure maintenance and more time focused on product and growth.

Lock-in is still a consideration, but it is not necessarily a trap. SaaS vendors often provide modern APIs, good documentation, and clear migration processes, though moving away from them can be costly and disruptive once your operations scale. Perpetual licenses give a little more autonomy over upgrades and data handling, but you remain dependent on the vendor for patches and ongoing support. Building in-house removes external lock-in altogether, but it shifts the dependency inward, onto your own ability to continuously hire, retain, and coordinate the right talent.

The real issue is alignment. A PayTech should evaluate whether the vendor’s financial stability, regulatory coverage, and product direction match its own ambitions. If the vendor is moving into new markets and expanding functionality in step with your strategy, the benefits of SaaS usually outweigh the risks. If your growth path is more unique, then reliance on a vendor may feel restrictive over time. In this sense, vendor strategy is less about constraint and more about partnership, shaping how smoothly your business can scale alongside the platform you choose.

How do scalability and differentiation shape the long-term value of a core banking solution?

Scalability is often the make-or-break test for any core banking solution. A PayTech may start small, but transaction volumes can grow exponentially, and regulators expect resilience from day one. Buying a SaaS-based core usually provides rapid elasticity, since vendors design their platforms to handle growth across multiple clients. This lets you scale without having to architect infrastructure yourself, though you will be scaling within the boundaries of the vendor’s design choices and cost structure.

Perpetual licenses can also scale well, but they require your team to take a more active role in capacity planning, upgrades, and infrastructure management. Building in-house gives you full control over scalability, but it means your engineers must anticipate future load, geographic expansion, and regulatory overhead from the very beginning.

Differentiation is the other side of the coin. If your competitive edge lies in offering super-app style products and services, novel settlement logic, bespoke reconciliation, or highly specialised compliance features, then building your own core gives you the freedom to experiment and innovate. A purchased core banking solution, especially in a full-stack model, is less about differentiation at the infrastructure level and more about efficiency, stability, and speed to market. The differentiation then shifts to the customer experience layer, pricing strategy, partnerships, or value-added services built on top of the core.

For most PayTechs, the real question is not whether scalability and differentiation matter, they always do, but where in the stack you want to achieve them. Building keeps the levers in your hands but demands long-term investment and foresight. Buying accelerates scale and reduces operational strain, but it channels your differentiation efforts toward areas above the core rather than within it.

The Hybrid Core Banking Solution: A Smarter Path Between Build and Buy for PayTech Firms

What about a hybrid approach to core banking solutions, and how does it address the needs of the most demanding PayTech firms?

The old binary of build versus buy no longer satisfies the ambitions of modern PayTech firms. The most forward-looking companies want speed to market and regulatory assurance in the short term, but they also want the freedom to shape their own future technology stack as they scale. A hybrid approach resolves this tension by combining the operational safety of SaaS with a credible pathway to technological independence. This is precisely where Baseella positions itself, bridging the immediate needs of agility and compliance with a long-term vision of autonomy.

Baseella has pioneered this model by offering both SaaS and perpetual license options. A PayTech can begin on SaaS, launching services in weeks while relying on Baseella’s compliance tooling, monitoring, and operational resilience. At a later stage, the firm can transition to a perpetual license that includes access to the source code and full developer documentation. This enables clients to take direct ownership of the core banking solution, extend it with bespoke features, and even re-architect parts of it to fit unique product or regulatory requirements, all without the disruptive leap of building from zero.

What makes this transition viable is Baseella’s modern, open-source technology stack: NodeJS, PostgreSQL, Elasticsearch, Redis, React, NestJS, Prisma, Terraform, and Kubernetes. By grounding the platform in widely adopted open-source frameworks, Baseella lowers barriers to entry for engineering teams, makes hiring easier, and ensures firms are not tied to proprietary black-box systems. This approach also accelerates knowledge transfer, as in-house developers can learn and contribute alongside Baseella’s team, gradually assuming greater control without jeopardising stability.

For senior leaders, the hybrid model offers strategic clarity. It aligns short-term speed with long-term sovereignty, de-risks regulatory expansion, and creates an asset base that can support fundraising, partnerships, or even M&A. For engineering and product leaders, it offers a practical roadmap: launch quickly, integrate cleanly, then scale into independence using technologies their teams already know.

Far from being a compromise, this hybrid approach is a deliberate strategy for PayTechs that refuse to choose between agility and control. It is the fastest way to build resilience today while securing the freedom to innovate tomorrow.

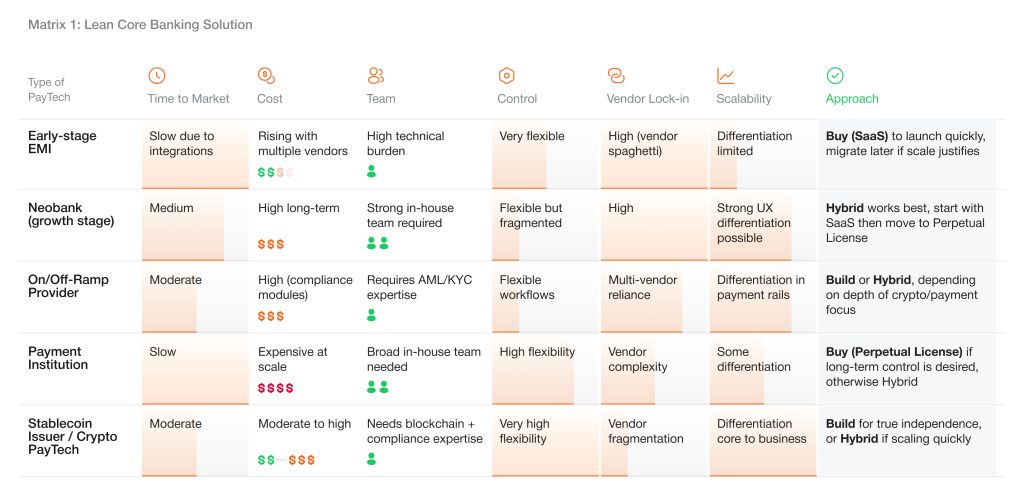

Lean Core Banking Solution: Evaluation Matrix for PayTech Firms

A lean core banking solution is best understood as a lightweight ledger and transaction engine, with most other functions, such as onboarding, compliance, monitoring and reporting handled by external systems and vendors. This model maximises flexibility and opens the door to highly tailored architectures, but it also introduces integration complexity, higher costs over time, and a heavy reliance on in-house technical talent.

Take a look at the matrix below to see the comparative evaluation on how different types of PayTech firms perform under this model across key decision areas. The far-right column translates these considerations into a recommended approach: build, buy (SaaS), buy (perpetual license), or adopt a hybrid path.

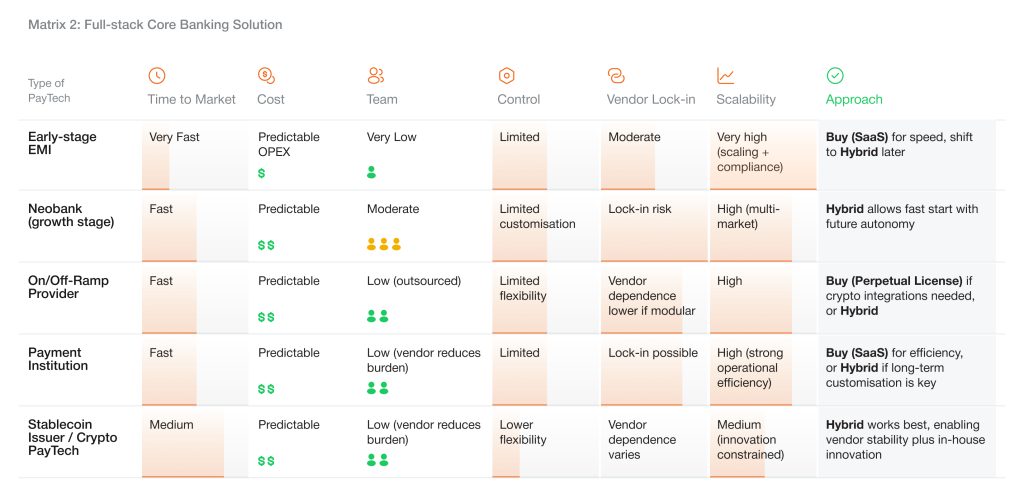

Full-stack Core Banking Solution: Evaluation Matrix for PayTech Firms

A full-stack core banking solution extends far beyond the ledger. It includes customer onboarding, KYC/AML, risk monitoring, reporting, payments orchestration, and often engagement tools, all within a single unified platform. This model minimises vendor sprawl and accelerates time to market, while providing operational resilience and regulatory assurance out of the box. The trade-off is less flexibility at the architectural level and a stronger dependency on the vendor’s roadmap.

The matrix below assesses how different types of PayTech firms align with this model. The recommendation column highlights whether building, buying via SaaS, buying under a perpetual license, or adopting a hybrid model is best suited to each case.

The choice between a lean core and a full-stack core, between building and buying, or even combining the two, ultimately comes down to strategy, stage, and ambition. What is clear is that PayTech firms no longer need to accept rigid trade-offs. With Baseella’s hybrid model, you can launch quickly under SaaS, then evolve into full independence through a perpetual license backed by open-source technologies, developer documentation, and structured knowledge transfer. It is the fastest way to achieve resilience today while securing the freedom to innovate tomorrow. To explore how this model can fit your journey, we invite you to learn more about Baseella’s core banking solution and book a demo with our team.

If you’re preparing to evaluate or replace your core banking software, we’ve created a comprehensive, vendor-agnostic questionnaire to guide your assessment. It covers the critical areas, such as technology, compliance, payments, security, and more – and is designed to help PayTechs structure their internal conversations and vendor comparisons with confidence. Sign up for our mailing list to receive your free copy and stay updated with insights on core banking strategy and PayTech innovation.