- Let’s Get the Basics: Crypto Terms That You Must Know

- Types of PayTechs: What They Do and Why They Matter

- Integration Infrastructure for Stablecoins and Crypto Payments

- Many Ways to Integrate, but is There One to Rule Them All?

- How Baseella Supports Stablecoin Integration and Fiat On/Off Ramps

- Charting the Road Ahead

The line between traditional finance and the blockchain world is fading fast. From everyday consumers funding a crypto wallet with a debit card to PayTechs moving millions across borders in seconds, fiat on-ramps, off-ramps and stablecoins are turning once-complex crypto processes into familiar, bank-like experiences. Yet some of the terms – EMIs, APIs, EMTs, treasury settlement “sandwiches” – can feel overwhelming.

In this article, we break it all down. You’ll discover the core vocabulary that underpins modern digital-asset payments, see why regulated PayTechs are racing to adopt stablecoins, and explore four practical integration models – from plug-and-play wallet APIs to launching a proprietary token. Across the payments landscape, the following sections offer the context – and the architectural playbooks – needed to bridge today’s fiat rails with tomorrow’s crypto economy.

Let’s Get the Basics: Crypto Terms That You Must Know

In the context of digital assets, fiat on-ramps are services or platforms that allow users to convert fiat currency (such as USD, EUR, GBP) into cryptocurrency, while fiat off-ramps convert cryptocurrency back into fiat. These ramp services may be operated by exchanges, payment processors, or banks, and are essential for crypto adoption because they link the crypto ecosystem with the traditional financial system. In practical terms, an on-ramp might let a customer use a credit card or bank transfer to buy crypto, whereas an off-ramp enables withdrawing crypto holdings as funds into a bank account. Without accessible and efficient on/off ramps, it is unlikely that a stablecoin or other cryptoasset would gain widespread acceptance beyond niche users. For non-bank FIs, partnering with or building on/off-ramp capabilities is a gateway to offering customers crypto services anchored in fiat value.

Stablecoins are digital currencies recorded on distributed ledgers (blockchains) that maintain a stable value by pegging to an external reference (usually a stable fiat currency like the U.S. dollar or euro, hence the name – “stablecoin”). They serve as a store of value and medium of exchange on blockchain networks, enabling users to transact in a unit that mirrors fiat value while enjoying crypto’s speed and programmability. Stablecoins essentially eliminate the fluctuating price concern of crypto assets like Bitcoin, while offering pretty much all the other benefits comparable to those of Bitcoin.

Unlike volatile cryptocurrencies, stablecoins are designed to minimise price fluctuations; this stability is typically achieved via full backing reserves (e.g. cash or government bonds) held by an issuer. For example, a USD-pegged stablecoin should consistently trade at $1 because each token is backed by $1 in reserve assets. Stablecoins allow near-instant, 24/7 payments without intermediaries, thanks to blockchain networks that operate continuously. They are also programmable – capable of interacting with smart contracts – which opens up use cases like automated escrow, conditional payments, and other “programmable money” features. Under forthcoming EU rules, stablecoins tied to a single currency for payments are termed “e-money tokens” (EMTs) and are legally akin to electronic money, with requirements to be issued by licensed institutions and redeemable at par value.

Types of PayTechs: What They Do and Why They Matter

When it comes to various types of non-banking institutions, PayTechs are non-bank but regulated players that handle money and payments. They stand to benefit from fiat on/off-ramps and stablecoins as these tools can extend their services into the crypto domain and unlock new efficiencies in how value is transferred.

PayTechs broadly refer to technology-driven firms in the payments space — including Electronic Money Institutions (EMIs), Authorised Payment Institutions (APIs), Payment Service Providers (PSPs), stored value platforms, neobanks, and infrastructure fintechs. While their regulatory profiles may differ, they share a common goal: modernising the way money moves by leveraging cloud-native software, open APIs, and next-generation technologies.

EMIs are licensed to issue electronic money — monetary value stored electronically, issued upon receipt of funds, and accepted for payment. Traditionally used in prepaid cards or digital wallets, some EMIs are now expanding their offerings by issuing blockchain-based e-money in the form of regulated stablecoins. Conversely, other PSPs offer services that facilitate payments for merchants and consumers alike — from card processing and remittances to real-time payments and digital wallet integrations. Increasingly, they’re adopting stablecoins and crypto rails to enhance speed and availability, with some already settling merchant payouts in assets like USDC.

Together, these PayTechs are leading the transformation of global payments infrastructure. Their focus on speed, low cost, accessibility, and innovation makes them natural adopters of stablecoins and fiat on/off-ramps — powerful tools to extend reach, streamline operations, and meet evolving customer expectations.

Integration Infrastructure for Stablecoins and Crypto Payments

Integrating crypto capabilities into a modern financial platform involves augmenting existing infrastructure, which is often cloud-based and API-driven for fintechs, with new components that handle blockchain-based assets. For PayTechs with cloud-native core banking systems, there are flexible paths to incorporate stablecoins or crypto services. Rather than a rip-and-replace of core systems, many see crypto integration as adding an additional payment rail alongside legacy rails like SEPA, BACS, CHAPS, SWIFT, ACH, or card networks. In this section, we’ll explore the key integration approaches and architecture considerations.

Option 1: Integrating Stablecoin Wallets via APIs

To start, PayTechs can integrate Stablecoin Wallets and APIs. Non-bank FIs can connect to established stablecoin infrastructures via APIs, thus allowing the PayTech to let customers deposit or withdraw funds in stablecoin form. By embedding stablecoin wallets into their systems, PayTechs essentially act as a user-friendly interface between customer bank balances and blockchain tokens. Modern core banking platforms like Baseella provide open APIs that make it easier to develop such integrations, treating a stablecoin transaction similarly to any other currency transaction in the ledger.

Option 2: On/Off Ramp-as-a-Service

Another option is to offer Fiat-to-Crypto On/Off Ramps as a Service. Many payment providers are adding services for customers to directly buy or sell crypto. A PayTech could integrate with a crypto exchange or liquidity provider in the backend. For instance, some fintech banking apps partner with exchanges so that users can purchase crypto with their fiat balance or cash out crypto back to fiat. This typically involves API integration with an exchange or licensed crypto assets service provider that handles the actual conversion and compliance, while PayTech provides the user interface and fiat wallet. The on-ramp side brings new revenue (through fees or exchange spreads) and keeps customers within the platform when they want to venture into crypto payments or investments.

The off-ramp side is equally important – allowing easy withdrawal to fiat gives users confidence that the digital assets are truly liquid. Non-bank institutions can differentiate themselves by providing smooth on/off-ramp experiences (e.g. instant account funding via cards, and near-real-time payout of crypto sales to the user’s bank account).

Option 3: Settlement via Stablecoins at the Back

Stablecoins can also be used for Treasury and Cross-Border Settlements. Even if end-users don’t directly transact in crypto, PayTechs can leverage stablecoins behind the scenes to improve their own operational efficiency. A prime use case is cross-border payments and treasury settlements between financial intermediaries. Similarly, a non-bank remittance provider could convert customers’ remittances into a stablecoin, transfer the value instantly across borders via blockchain, then pay out in local fiat at the destination. This “stablecoin sandwich” (fiat -> stablecoin -> fiat) can be faster and cheaper than traditional correspondent banking. It takes up to three days to make such a settlement using SWIFT, and only a few seconds when using stablecoin.

PayTechs specialising in global transfers see stablecoins as an alternative to correspondent bank networks, providing near real-time funds delivery 24/7. In practice, implementing this requires the PSP to maintain wallets on public blockchain networks and manage liquidity in both fiat and stablecoin. Compliance checks (e.g. sanctions screening on crypto addresses) are integrated into this flow. But the benefit is significant: transactions that once took days and cut off on weekends can now settle in seconds.

Option 4: Issuing Your Own Stablecoin

A more ambitious integration path is for a PayTech to issue its own stablecoin, essentially tokenising fiat currency under its management. This effectively puts PayTech’s electronic money on a public blockchain, making it interoperable with the broader crypto markets.

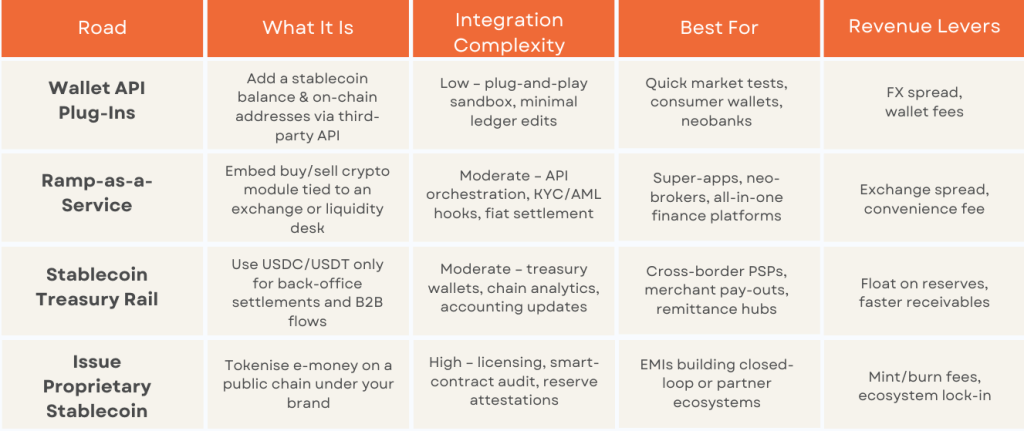

For a PayTech, issuing a stablecoin requires robust infrastructure: smart contracts for token management, reserve management to hold 100% fiat assets backing the tokens, an issuance/redemption mechanism (often via an API or platform for users to swap fiat and tokens), and cybersecurity safeguards for the smart contract keys. They must also integrate this token into their core ledger – each token in circulation is a liability of the issuer, just like a normal e-money balance. Modern core banking platforms can be extended to handle such on-chain liabilities, but careful reconciliation between on-chain supply and off-chain records is vital. The strategic advantage of issuing a proprietary stablecoin is brand and ecosystem control: the EMI’s stablecoin could be used by a network of partners or developers, embedding the issuer’s services into emerging Web3 applications. From simple plug-ins to full-scale token issuance, here’s a quick comparison of the four main integration paths PayTechs can take to enter the crypto space.

Many Ways to Integrate, but is There One to Rule Them All?

Underpinning all these integration options is a technology stack that can talk to blockchain networks or crypto services. Most PayTechs today use cloud-native core banking systems which are modular and API-first. This means adding a new “asset class” like a crypto wallet or stablecoin account for a customer can be done via configuration and connecting external APIs, rather than rewriting legacy core code. For example, a cloud core might allow creating a multi-currency wallet for users – one of those currencies could be a stablecoin. The transactions can invoke an API call to a blockchain gateway (which handles the on-chain transaction broadcasting).

Many fintech cores also support webhooks and real-time event processing, which can synchronise on-chain events (like an incoming token transfer) with the core ledger. Additionally, Banking-as-a-Service providers and open banking frameworks mean PayTechs don’t have to build everything from scratch – they can use specialist providers: custodial wallet providers for holding private keys securely, compliance API services for blockchain analytics (to flag illicit funds), and exchange APIs for liquidity. The architecture often consists of microservices: one service might handle price quotes and conversions (for on/off ramping), another manages user crypto addresses and deposit detection, and another interacts with core banking to credit or debit customer balances. All these pieces must be orchestrated to appear seamless to the end-user.

To conclude, non-bank FIs have a variety of integration strategies – from simply accepting stablecoins as a payment method, to deeply embedding blockchain-based money into their platforms. The guiding principle is usually to extend the existing value proposition (faster payments, global reach, new asset classes for users) rather than to become a full-fledged unregulated crypto exchange. A gradual approach, such as starting with stablecoin settlements or third-party crypto services, then moving to issuing own tokens if demand proves strong, is a prudent strategy. This implies that once an institution builds core competencies in crypto integration, adding new coins or use cases becomes much easier, paving the way for continual innovation in services offered.

How Baseella Supports Stablecoin Integration and Fiat On/Off Ramps

Baseella’s modern core banking platform is built for modularity and interoperability, making it an ideal foundation for PayTechs and EMIs seeking to integrate stablecoins and fiat on/off-ramp services. With open APIs, multi-currency ledger support, and cloud-native infrastructure, Baseella allows institutions to treat stablecoins like any other currency – enabling seamless transactions, wallet integrations, reconciliation processes, management and financial reporting. Whether you’re connecting to a crypto liquidity provider, embedding a stablecoin wallet, or launching your own tokenised money product, Baseella provides the compliance-ready tools and flexible architecture needed to build, scale, and adapt in a fast-evolving digital finance environment.

Charting the Road Ahead

Stablecoins and fiat on/off-ramps are no longer fringe utilities; they are fast becoming essential rails for modern payments. By mastering the key terminology, recognising the unique advantages of regulated PayTechs, and choosing an integration model that suits strategic goals, institutions can unlock 24/7 settlement, lower cross-border costs, and programmable money features that yesterday’s infrastructure simply could not deliver.

Whether the next step is embedding a plug-and-play wallet API, adding ramp-as-a-service fees, settling treasury flows in tokenised dollars, or even issuing a proprietary stablecoin, the path is clearer than ever—and the competitive stakes higher. Platforms like Baseella demonstrate that cloud-native cores already have the flexibility to treat stablecoins as just another currency object, making incremental adoption both technically feasible and compliance-ready.

The takeaway is simple: start small, iterate quickly, and let customer demand guide deeper blockchain integration. In doing so, PayTechs, EMIs, and PSPs can future-proof their offerings and play a pivotal role in bridging today’s fiat economy with tomorrow’s crypto-powered financial landscape.