All of what your PayTech startup needs in one core

Baseella is solving key problems that PayTech startups are facing with the poorly designed systems. We have developed a robust core banking system architecture that can withstand the test of time.

Baseella core banking system features

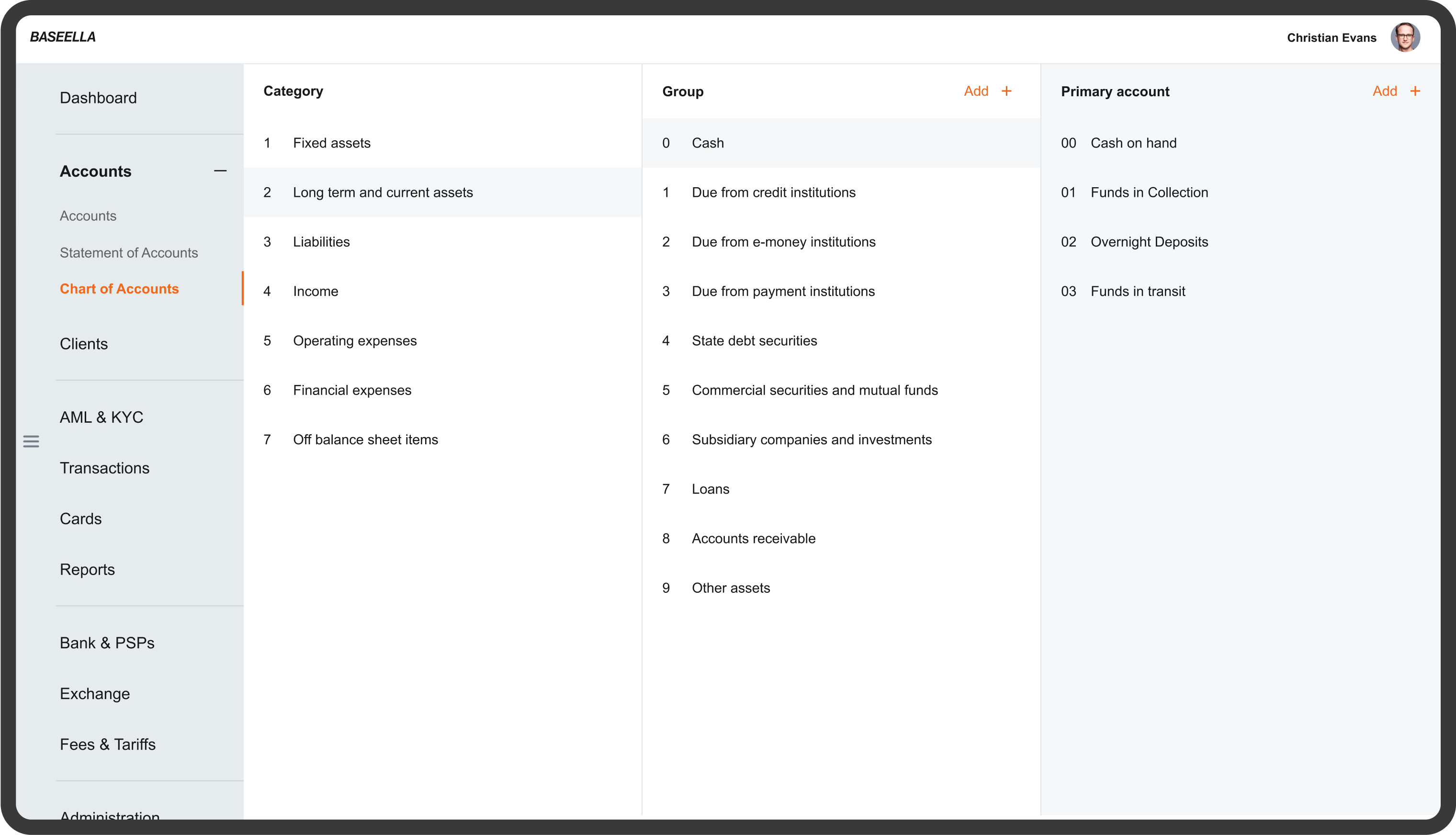

General ledger

Baseella was designed, first of all, as an accounting system around the general ledger. It records customer transactions, revenues and expenses, and PayTech’s own transactions, such as movements between partner bank accounts, salaries, taxes, office rent, amortisation, etc. All accounts are multicurrency, and balances are actualised automatically to present correct figures in the functional currency for financial reporting.

IFRS-based chart of accounts is fully customisable and can be modified to suit any PayTech company’s needs. The general ledger enables recording any transaction without limitations. An editable chart of accounts and clear designation of the accounts allows PayTech to produce any financial or management reports required. It is one of the core banking system features that are rarely available in other software solutions.

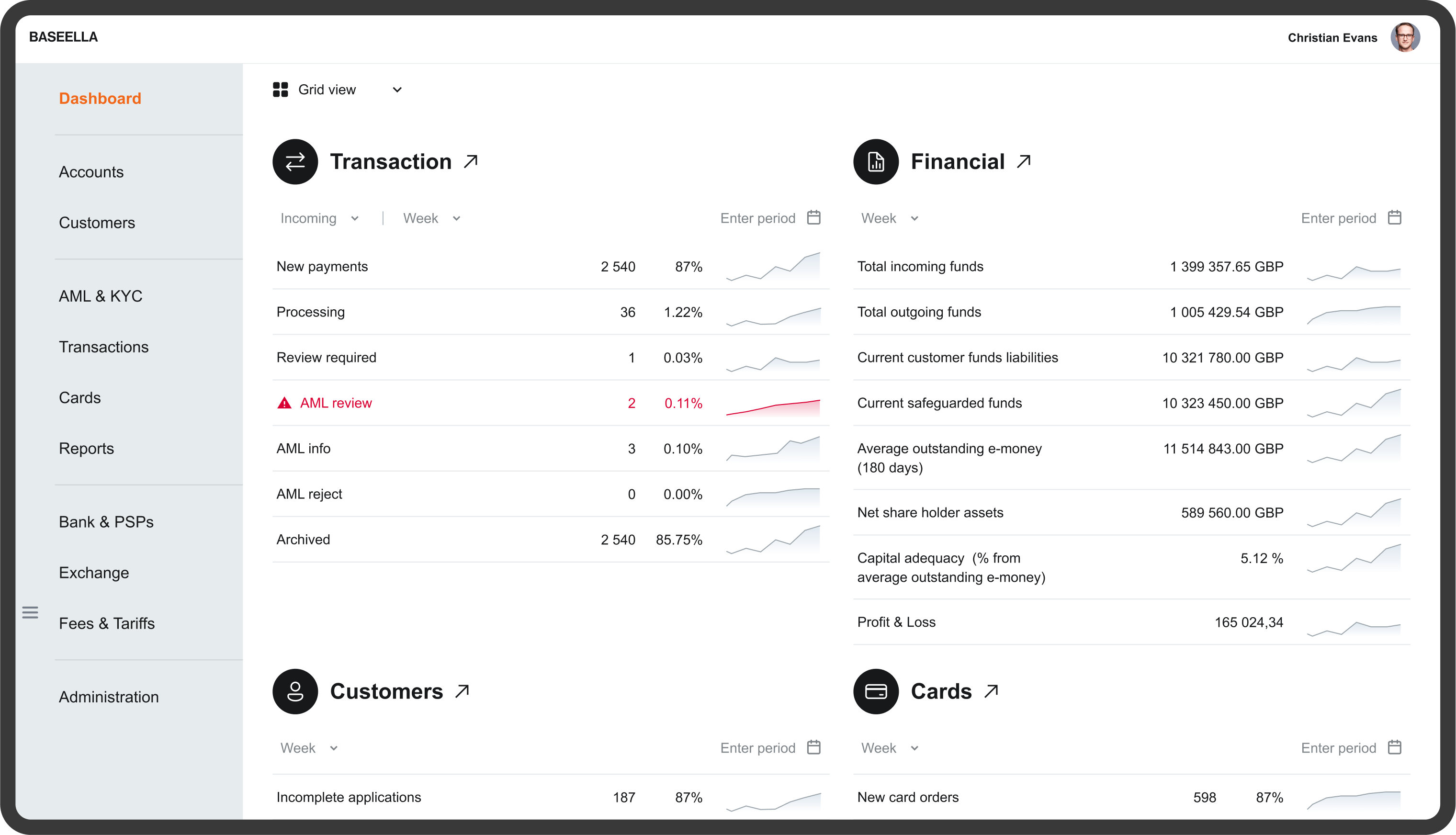

Management dashboard

Baseella dashboard is a single source of essential PayTech company performance information. It includes transaction processing, compliance statistics, and financial information such as regulatory capital adequacy and profitability. It is an essential fragment of robust core banking system architecture and sits as a centrepiece for management.

Using the dashboard, management can monitor how effectively the team processes new customer and card applications, statistics related to unanswered customer queries or complaints, and other data points.

Customer onboarding

Baseella has built-in customer onboarding functionality that can be modified to include PayTech company-specific AML/CTF workflow and compliance tools.

Baseella is supplied with native integration of biometric identification and ID authentication provided by our preferred partner Sumsub; however, any third-party solution can be integrated. Our scalable core banking system architecture allows for adjustments to parts of the software and the utilization of other preferred solutions.

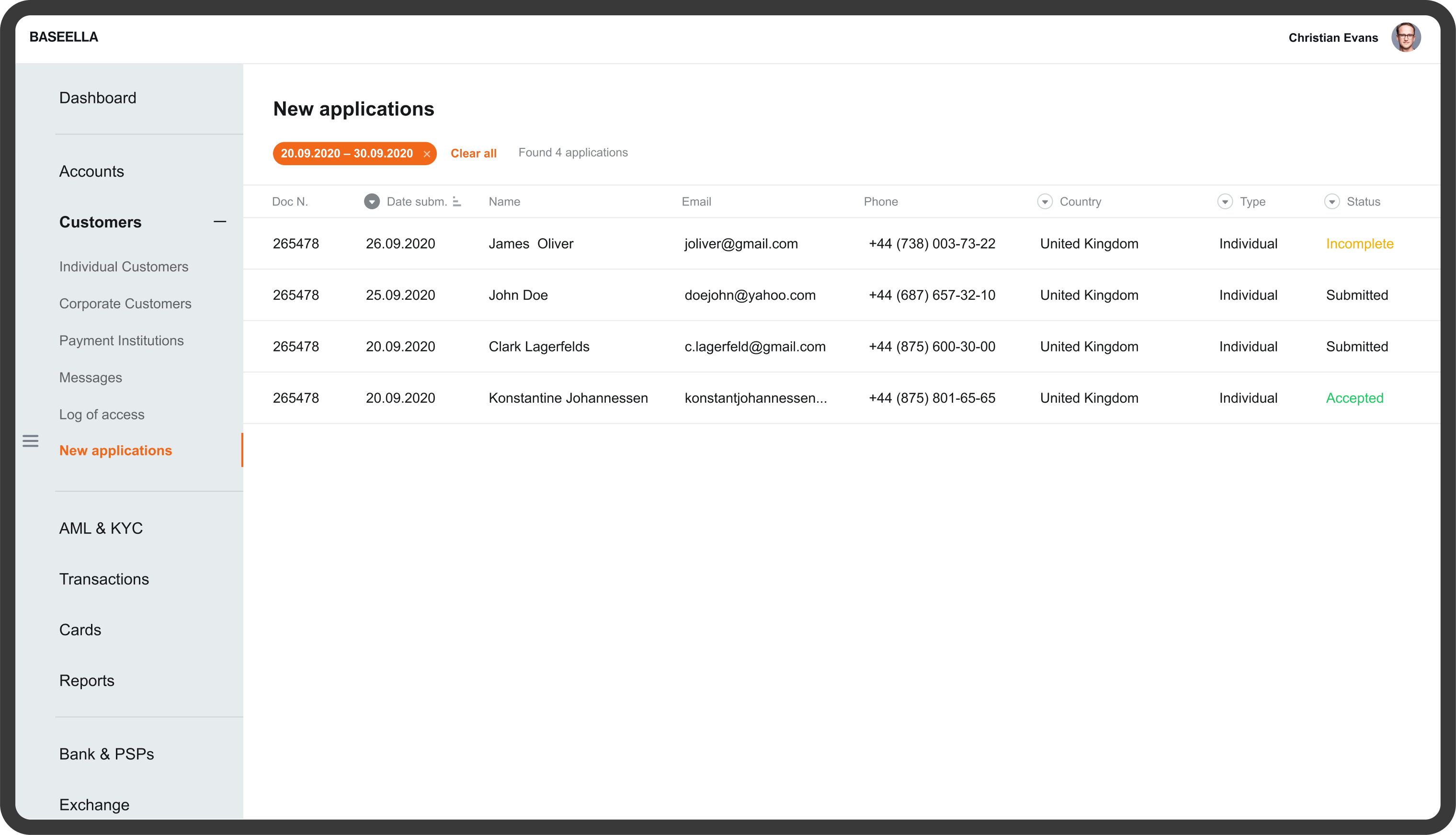

Onboarding centre

This module is embeded within our core banking system arthitecture and provides a centralised approach to new application reviews and processing. For example, this could be a new customer or a company onboarding request, payment card issuance, or an additional e-wallet or payment account opening application.

An onboarding specialist can sort the application by the date, type of customer, status, location, and other parameters. A supervisor can monitor progress, allocate complex applications to senior employees, and review cases referred by subordinates.

Customer due diligence

Once a new customer application is completed, the onboarding specialist can perform all necessary checks, review supporting documents, biometric identification and ID verification results, sanctions, PEP, and adverse media screening results and decide to accept or reject the application.

The new customer onboarding workflow can be modified to provide an automated onboarding of the new customer that passed all checks and was assigned a low-risk score. The workflow of the new payment card issuance or additional e-wallet or payment creation can be modified to be fully automatic or require manual verification based on the customer’s risk profile.

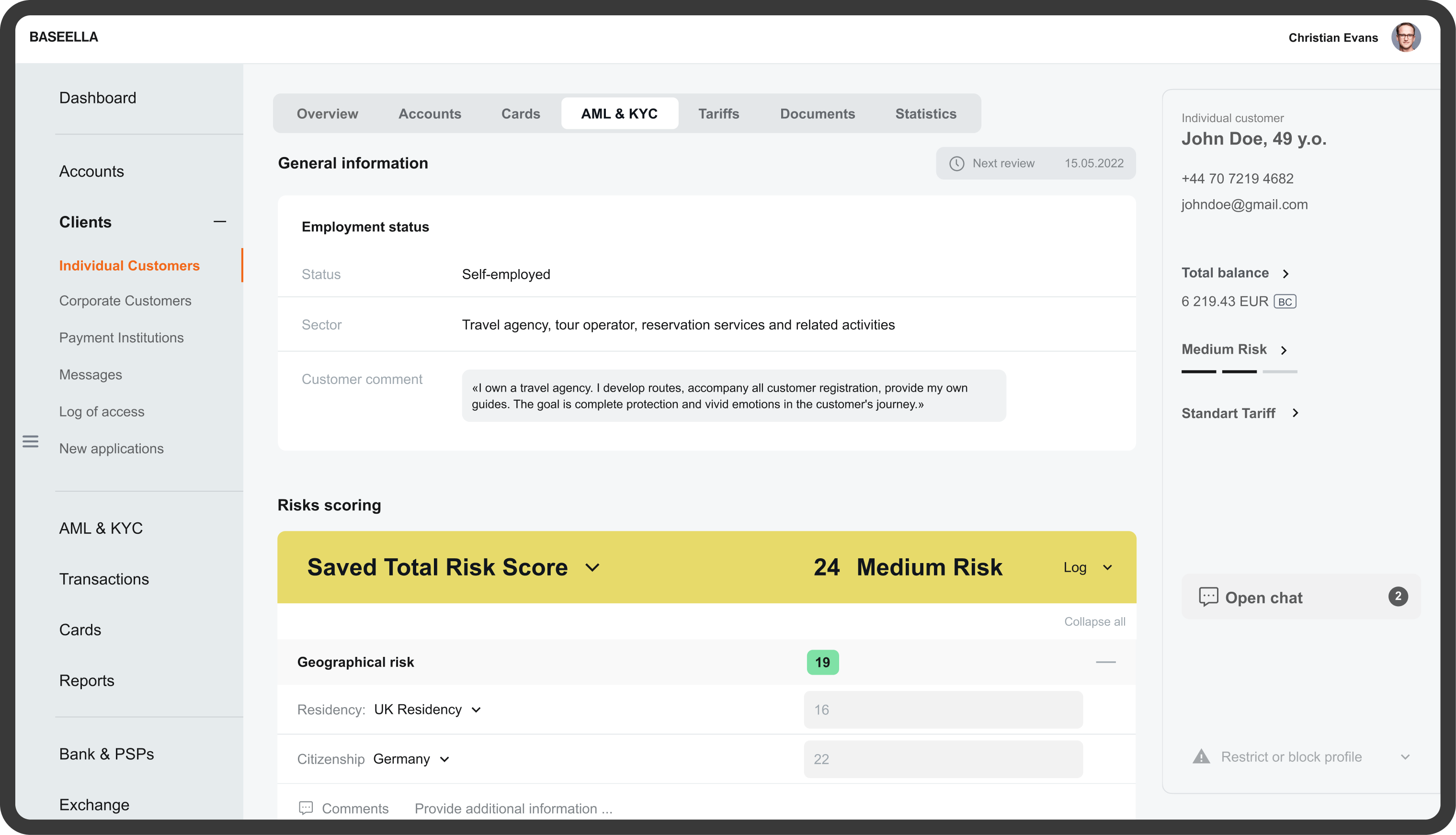

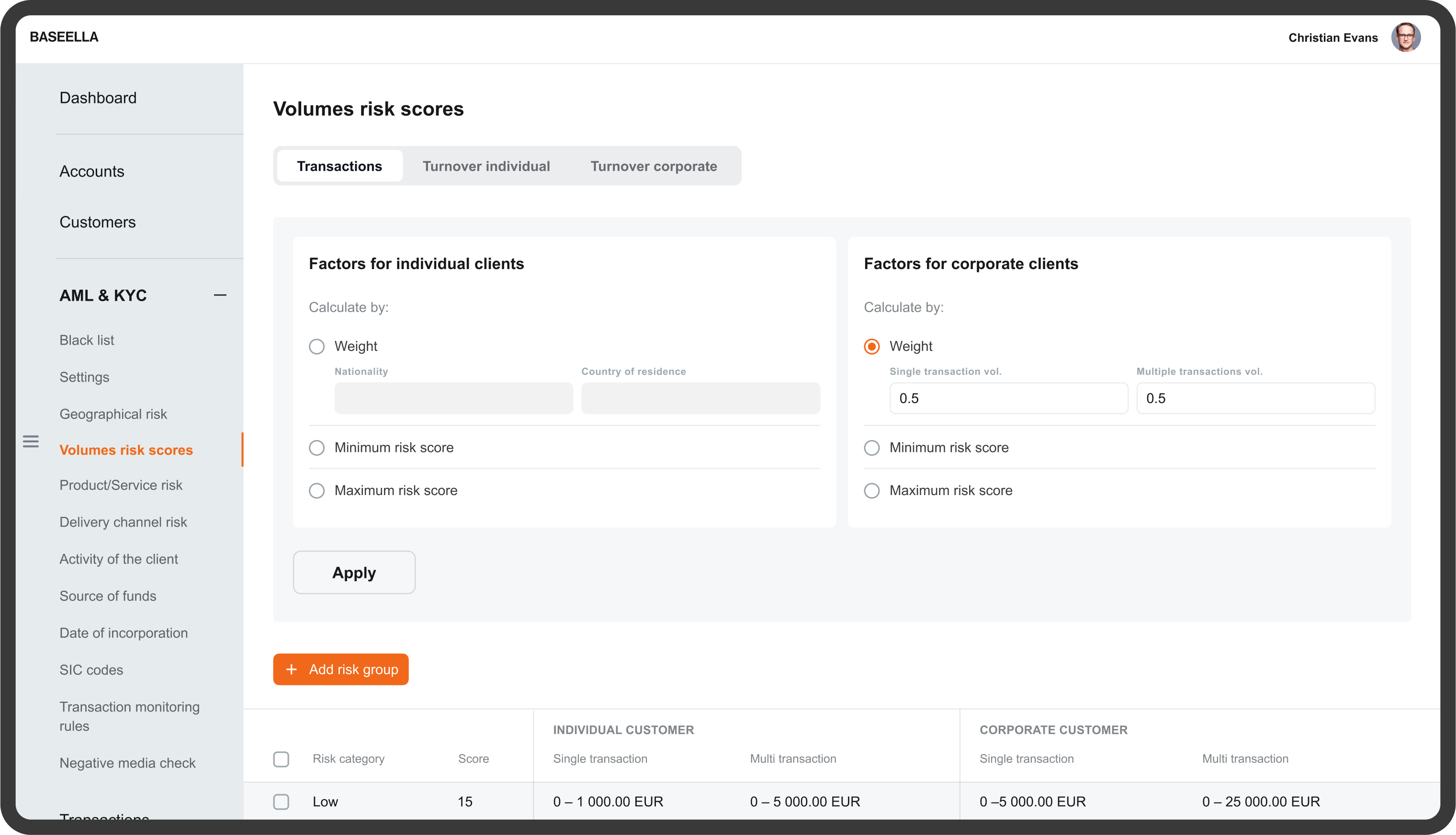

Customer risk scoring

Baseella has fully automated risk scoring of the customers, which is fully configurable by PayTech’s compliance personnel and includes risk factors, such as delivery channel, geography, customer type, SIC codes, transaction volume, and product type, as a native part of our core banking system features.

Compliance personnel can set various score parameters based on the risk appetite of the PayTech company and its risk management policies and procedures. The customer’s risk scoring is dynamic and updated based on the customer’s transaction risk profile. Baseella will prompt compliance personnel to perform periodic reviews of the customers based on the preset periodic review intervals for each risk category.

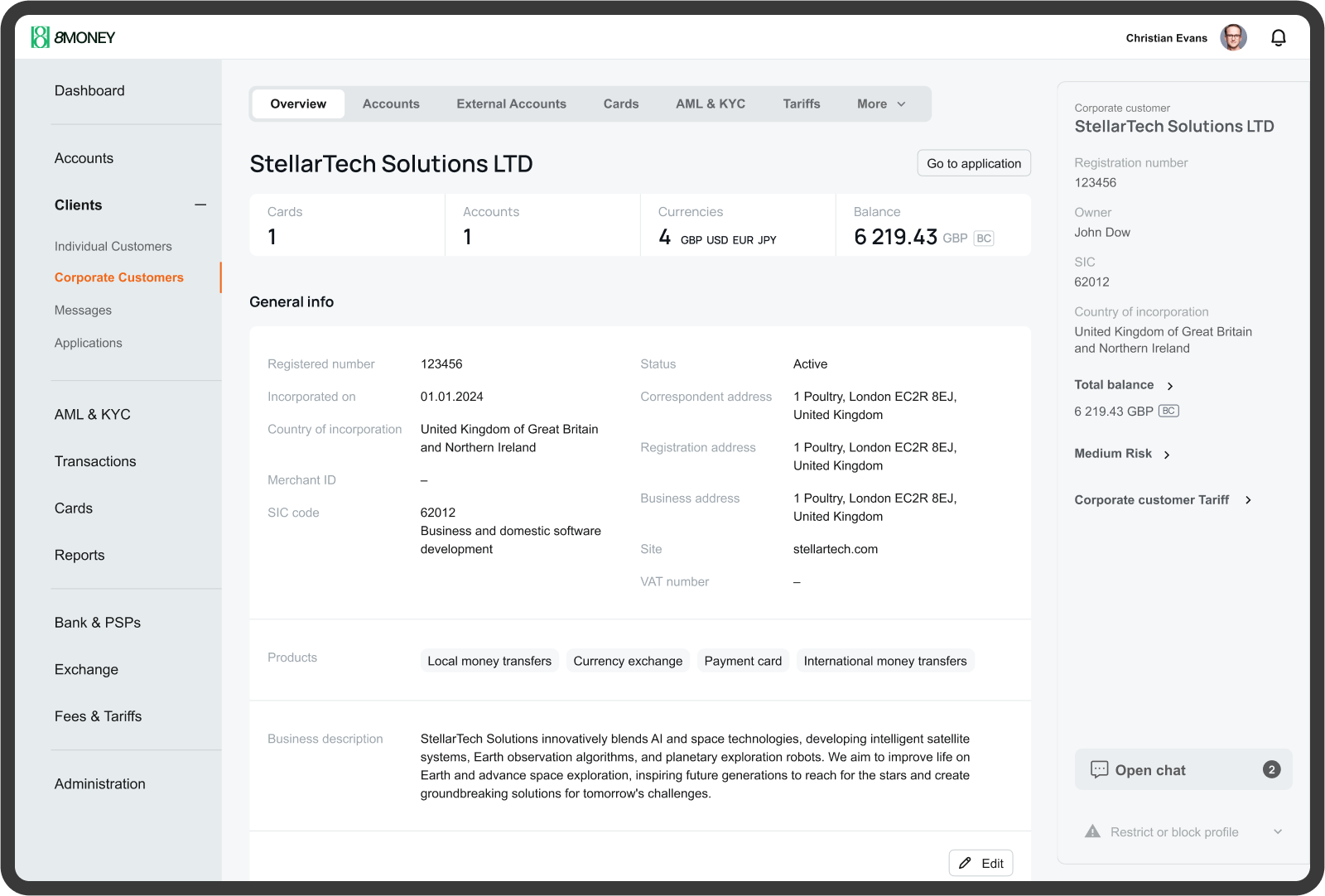

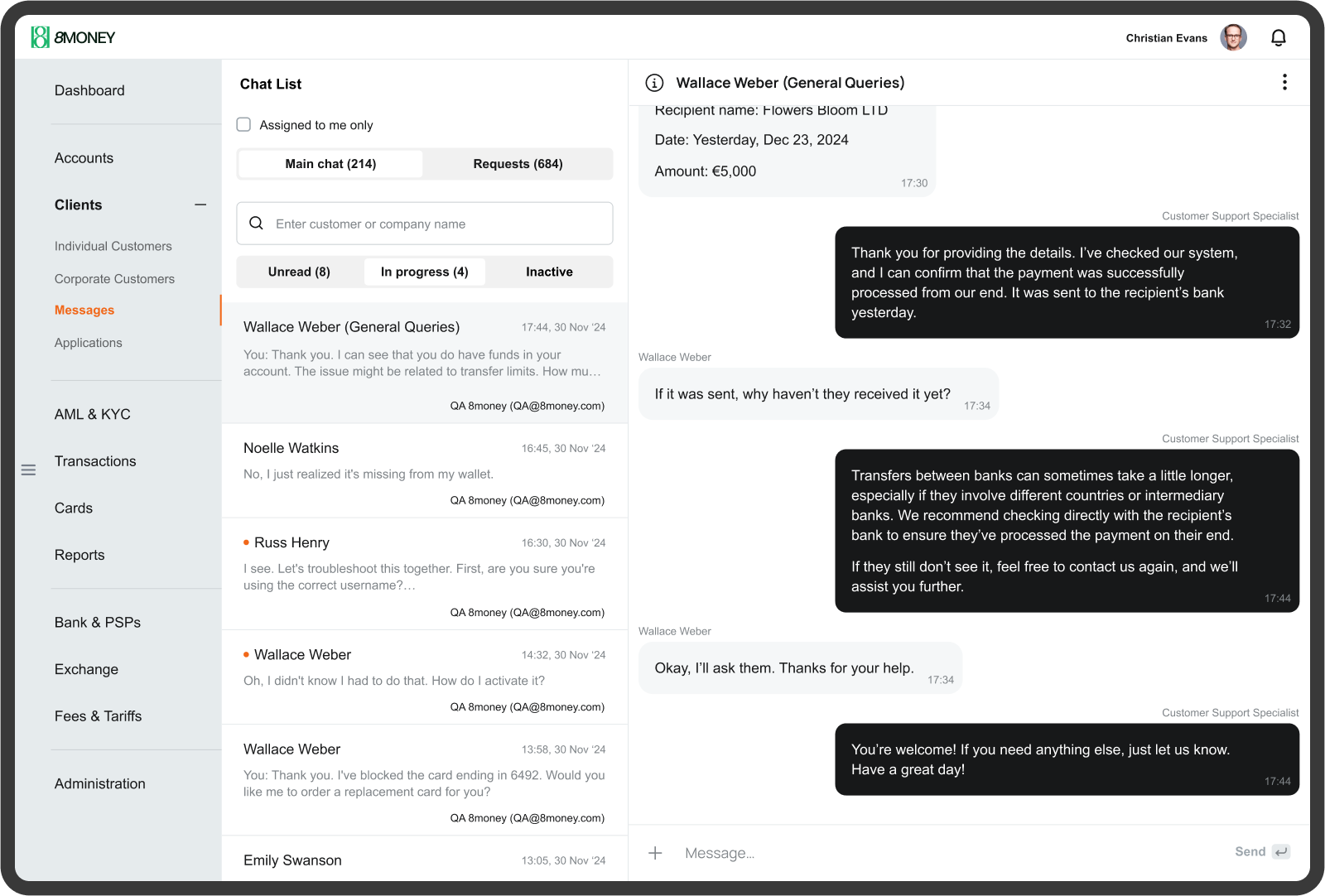

Customer relationship management

Baseella is more than just a core banking system acting as a source of truth and record retention system – it is a fully integrated CRM platform designed to streamline and enhance customer interactions. With Baseella, customer communication is simplified through an embedded, secure chat system that integrates with all activities within the platform. This includes managing transactional queries, responding to customer requests, and retaining customer documents and information, ensuring a unified and secure communication flow. To further enhance engagement, Baseella supports push notifications for important updates, ensuring your customers are informed in real-time.

In addition, Baseella features a powerful statistical analytics engine, providing in-depth insights into each customer’s profitability and interaction trends.

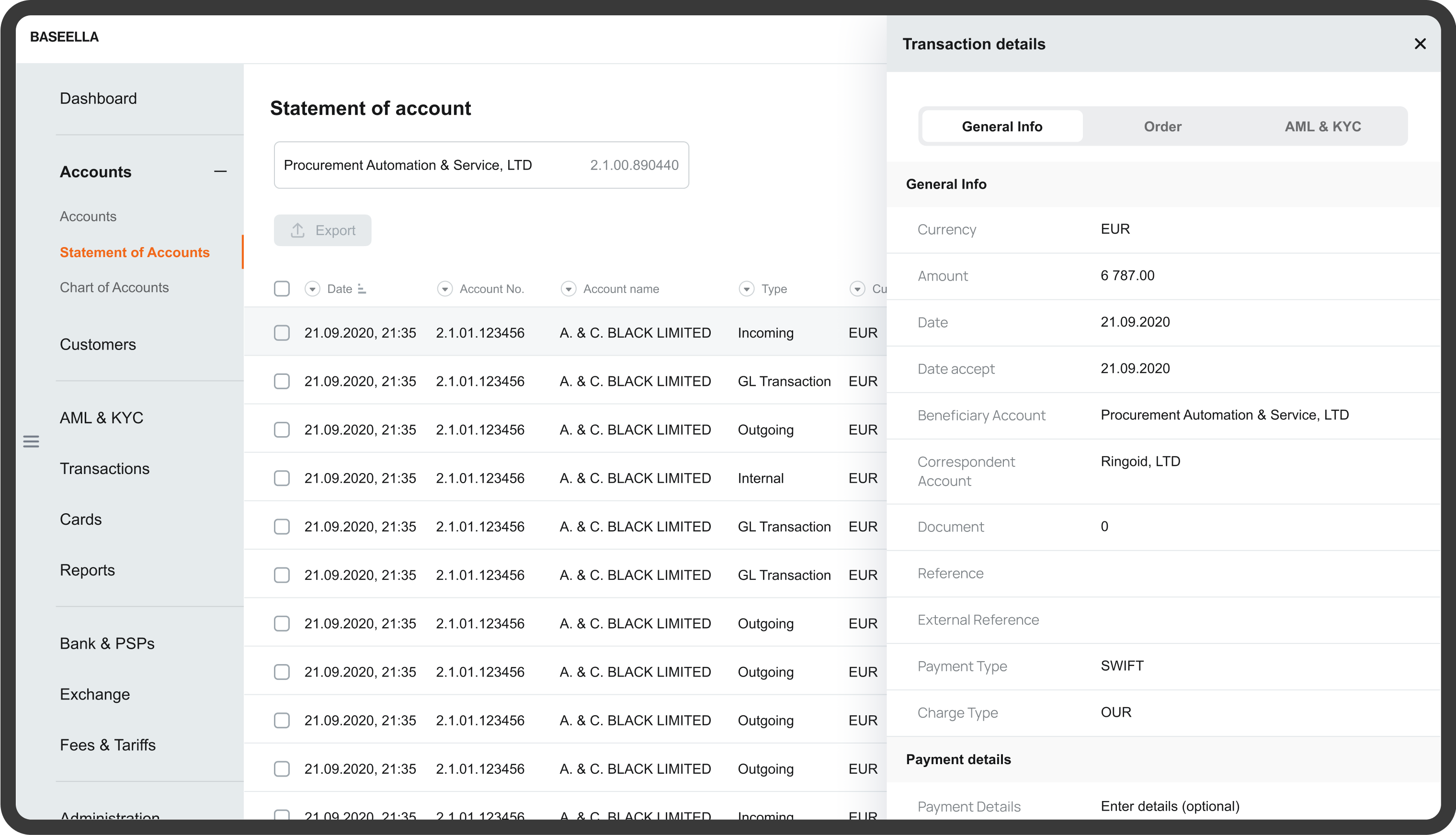

Statement of account

A versatile and fully customisable statement of account provides the necessary information to the authorised PayTech company employees on any account transaction. Moreover, any statements can be exported into Excel, CSV, or pdf.

Baseella core banking system’s Open Banking API enables PayTechs, considered as Account Servicing Payment Service Providers (ASPSP), to comply with the PSD2 requirements and allow third-party Account Information Service Providers (AISP) to access PayTech’s customer account data and transaction history. We built our core banking system architecture with all regulatory requirements in mind, so you can be at ease.

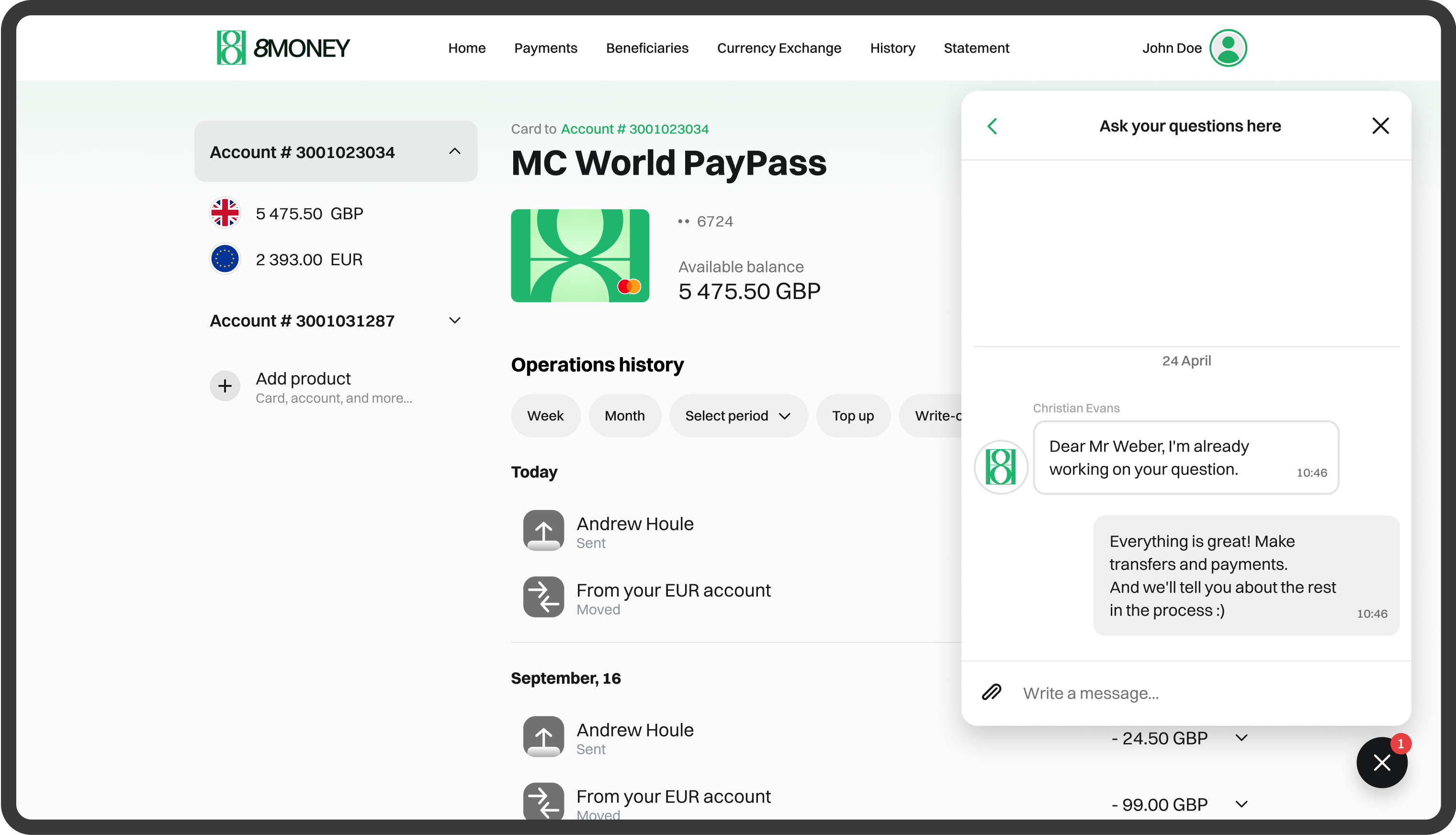

White-labelled Internet bank

With Baseella, you get a white-labelled internet bank that reflects your brand identity and provides your customers with a seamless and customised online banking experience. A white-labelled internet bank allows you to offer electronic money and payment account services under your own brand while leveraging Baseella’s robust core banking system architecture and comprehensive feature set.

The white-labelled internet bank is designed with a user-friendly interface, ensuring an intuitive and seamless banking experience. The interface supports all popular money transfer methods and can be tailored to meet your specific requirements, local and/or alternative payment methods, allowing you to prioritise features and functionalities based on your target market and customer preferences.

Incoming payments processing

Incoming payment orders are presented in a single dashboard, regardless of the clearing system or partner banks/PSPs they arrived from, be it Faster Payments, SEPA, SEPA Inst, SWIFT, or another local, regional, or alternative payment method.

Payments officers can easily navigate and filter incoming orders by various parameters. Incoming payment processing workflow can be automated for low-risk orders with no red flags, or manual when the risk score is high, or when there is a rule triggered, or a plausible sanctions list match. Our advanced core banking system architecture ensures seamless integration of these payment processes for optimized efficiency.

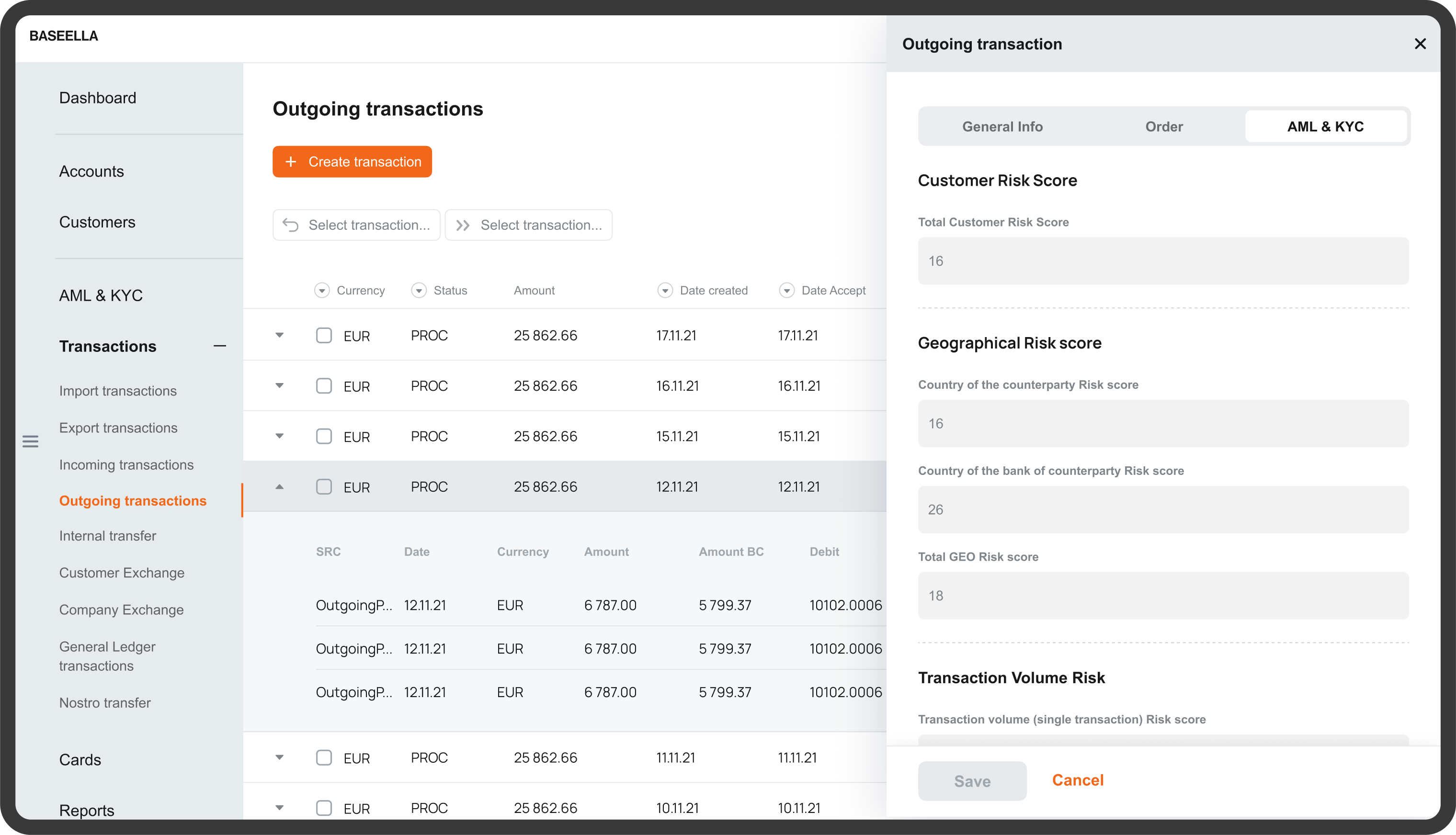

Outgoing payments orchestration

The outgoing payment orders orchestration module automatically detects the payment type and clearing system that must be used, suggests the safeguarding bank, or a pay-out partner PSP, that supports the required payment type and have sufficient balances of customer’s funds. The outgoing payment orders (once signed off in a sequence established by PayTech) are either sent via API to the partner bank/PSP or exported into the desired format for manual upload.

Payments officers can easily navigate and filter outgoing payment orders that can be processed automatically if the transaction risk score is low, manually if it is high, or when there a rule triggered, or a plausible sanctions list match. Complex, high-risk cases can be referred to the supervisor or compliance department using Baseella’s intra-company notification system. The outgoing payments processing workflow is fully configurable and tremendously helpful in operations optimisation thanks to thought out core banking system architecture.

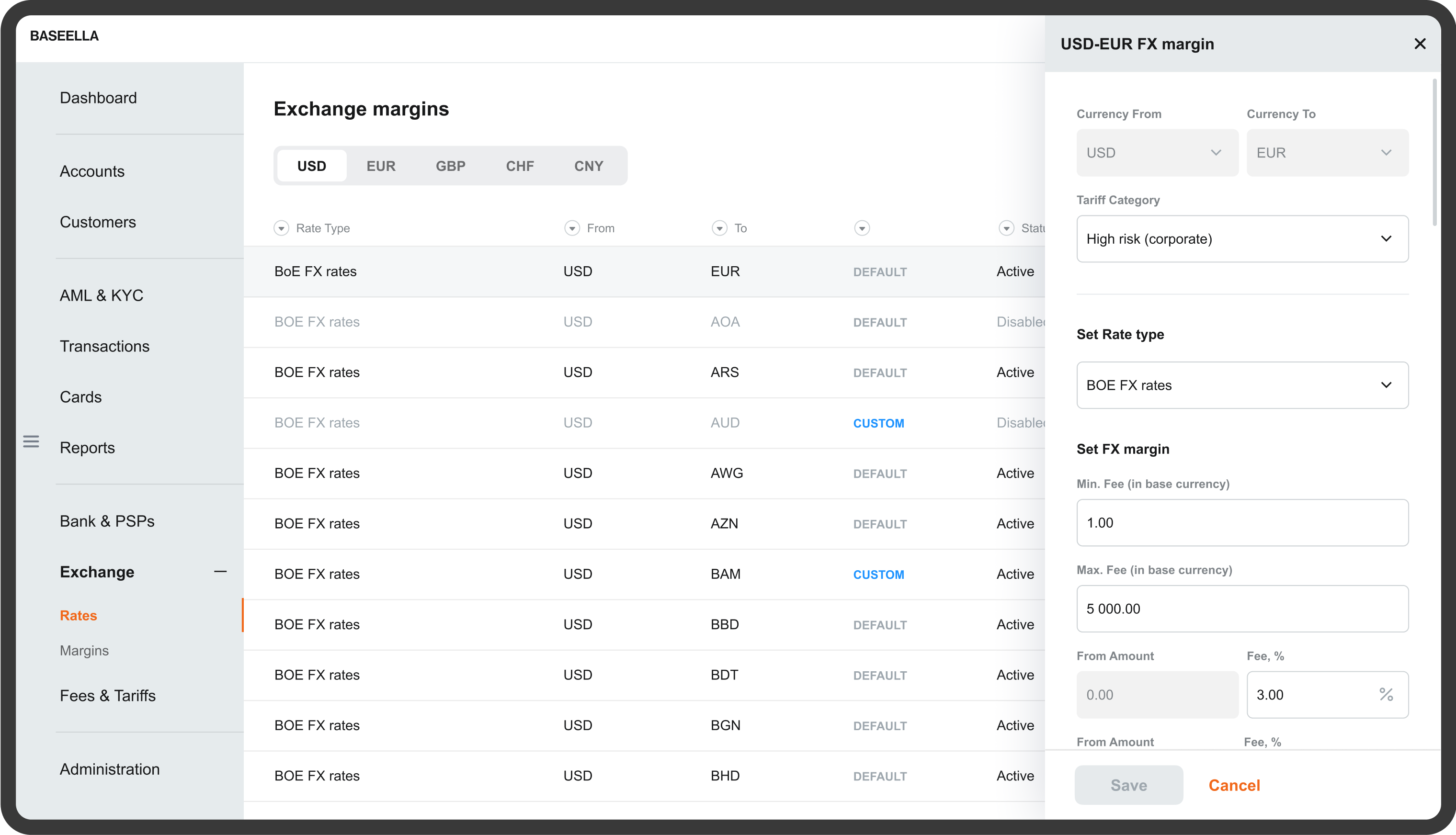

Foreign currencies and FX

Our core banking system architecture is desinged in a way that all accounts, including customer payment accounts/e-wallets, are multicurrency by default. Each customer is issued with a single payment account/e-wallet number that supports all currencies. Virtual IBANs can also be assigned to any customer if PayTech has arrangements with third-party providers to do that or if PayTech is SEPA adherent in its own right.

Baseella supports rates and exchange of any existing currencies. PayTech must choose a single functional currency in which it will keep its books and then enable any foreign currencies it will provide to customers. Exchange rates are downloaded and updated automatically from BoE, ECB, or any other source. Currency exchange operations are seamless and can be conducted via internal or external SPOT. Different FX fees can be set for various client groups or even individually assigned to a client.

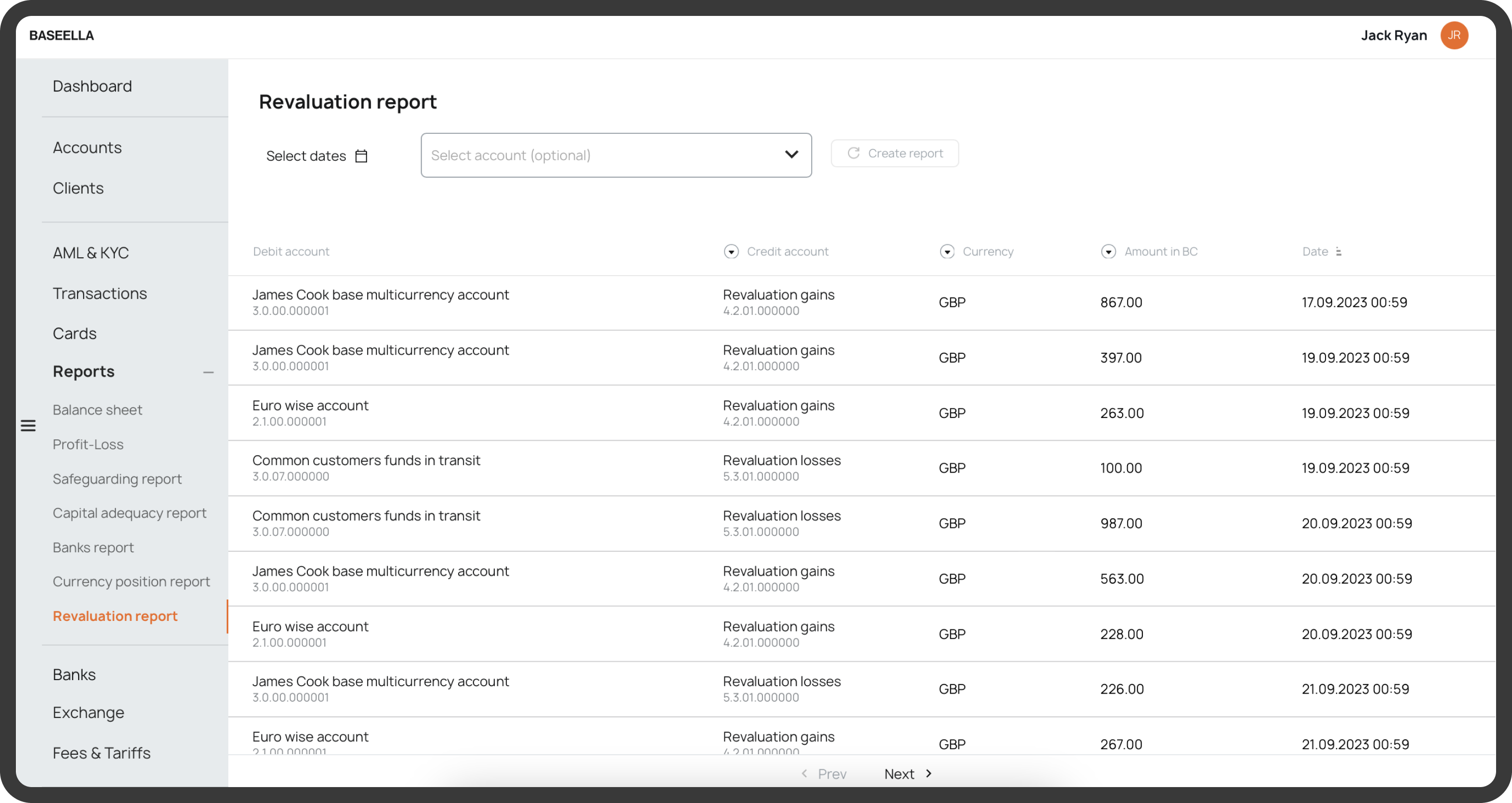

Revaluation

PayTech firms using Baseella core banking system have the capability to revalue balance sheet account values denominated in foreign currencies In accordance with IFRS. This revaluation process serves to accurately reflect changes in conversion rates between the initial journal entry date and the subsequent date of receipt or payment of the foreign currency amount. Within general ledger, the system ensures that any alterations in converted balances are appropriately recorded against the designated unrealised gain/loss account. Whether PayTech firm need to revalue a single account or a range of accounts, the functionality is readily available to meet the specific requirements.

Upon initiating the revaluation process (which is conducted at pre-set intervals), general ledger automatically generates a dedicated revaluation batch, each containing a distinct journal entry for every revalued foreign currency. It’s important to note that these revaluation adjustments are executed in PayTech firm’s functional currency. This is how the accurancy of the balance sheet, profit (loss) statement, safeguarding reconcilaition, capital adeaquacy, and other reports is ensured, as any assets and liabilities held in currencies other than functional currency are revalued periodically to account for any fluctuation in exchange rates.

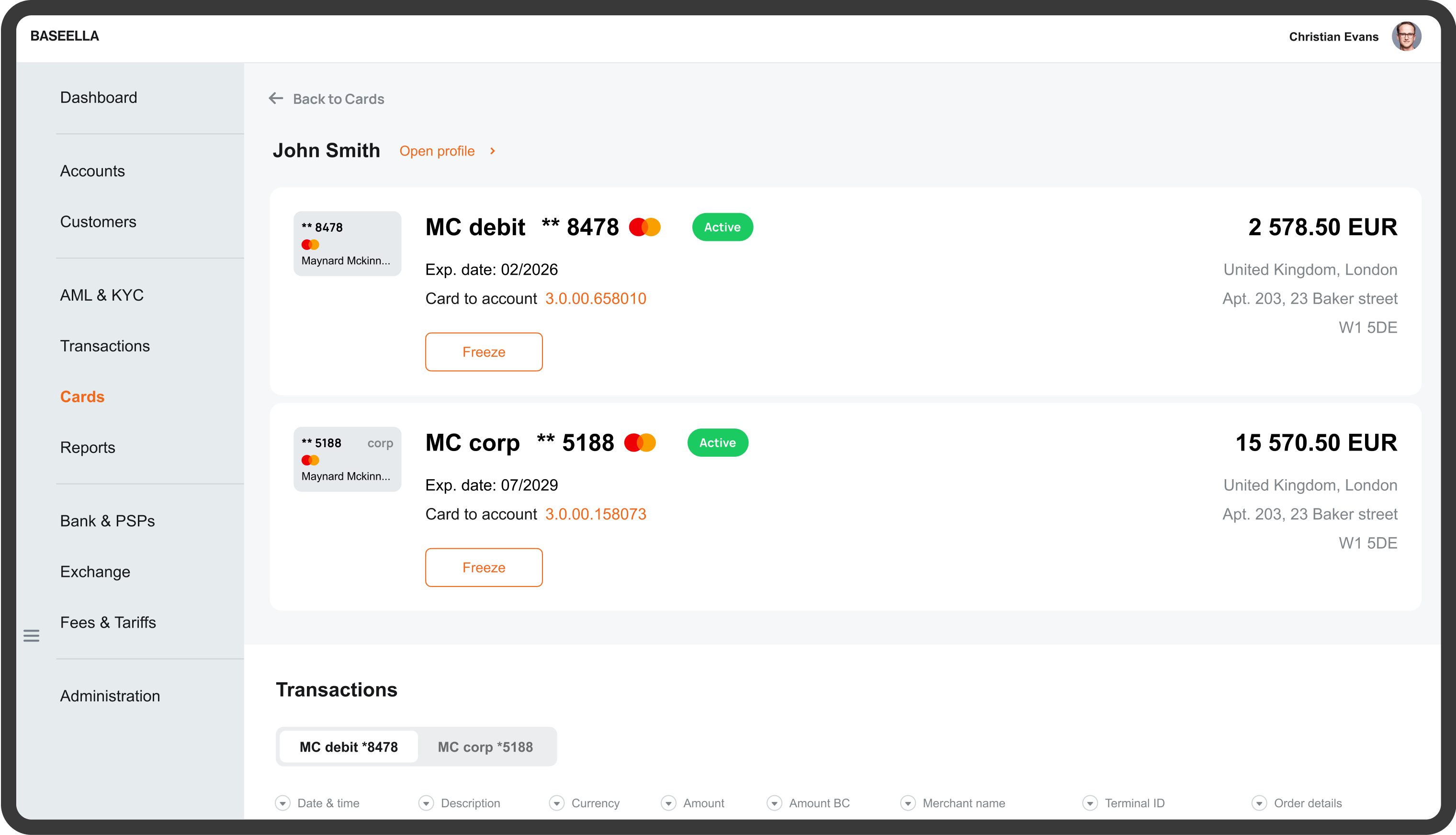

Cards module

The Payment Cards module offered by Baseella is designed to empower PayTech firms with comprehensive functionality to manage and streamline payment card operations. This module covers various features and capabilities, such as Card Issuance and Management, Card Lifecycle Management, Transaction Monitoring and Authorisation, Cardholder Self-Service, Card Security and Compliance, Integration with Perso Bureaus and Processors, Reporting and Analytics.

Baseella enables PayTech firms to issue and manage payment cards seamlessly. From virtual cards to physical cards, thanks to robust core banking system arthitecture you can quickly generate and assign cards to customers, track card statuses, and manage expiration dates. The module supports various card types, including debit, credit, and prepaid cards and various card issuance arrangements, from co-branded cards or BIN sponsorship arrangements to PayTech firm’s own principal membership with card networks.

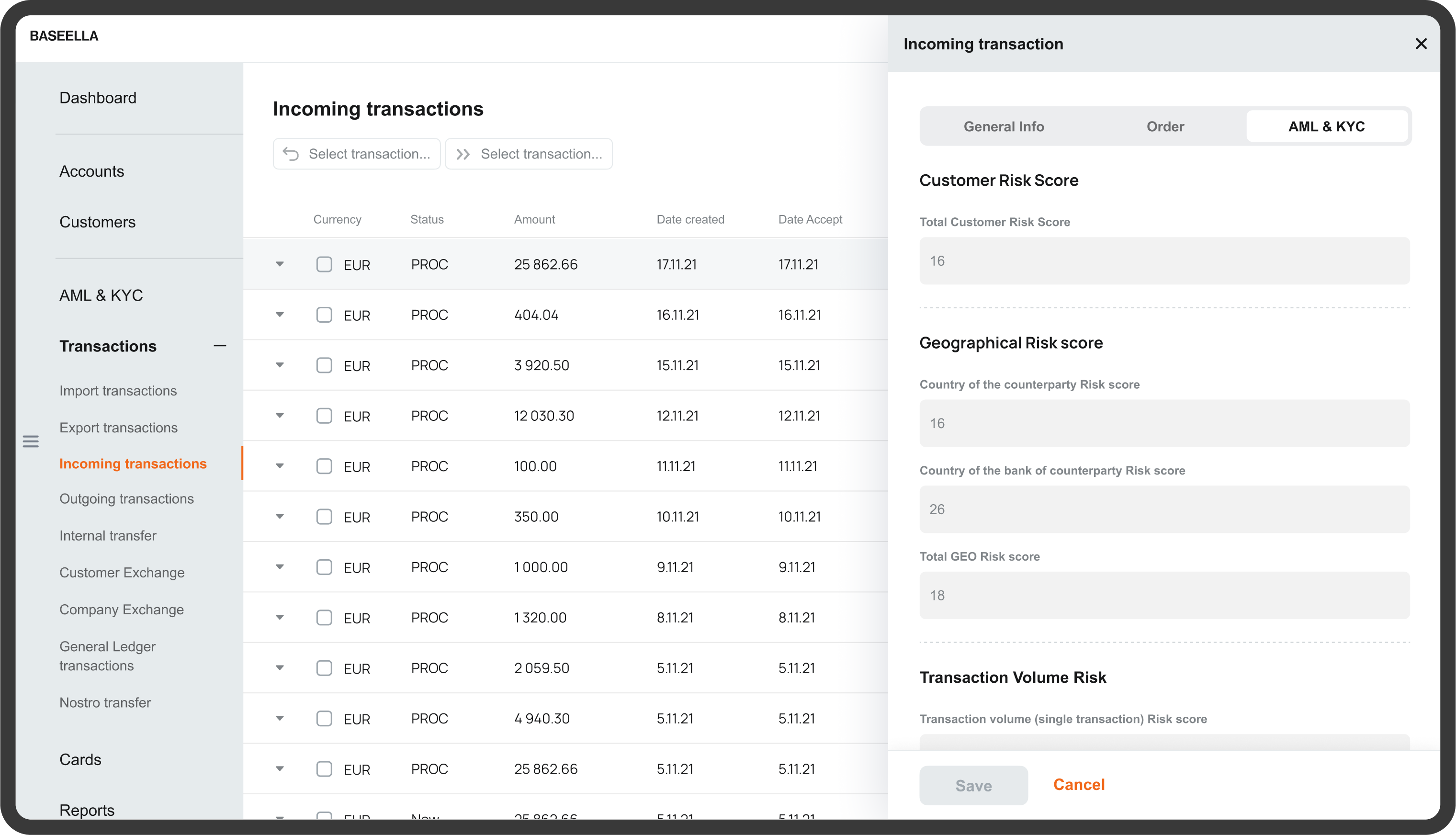

Transaction risk scoring and monitoring

One of the unique features of Baseella core banking system architecture is a centralised transaction monitoring function, where each transaction is assigned a risk score based on the customer type, geographical location of the payer/payee and payee’s bank, value and type of payment transaction. This allows PayTechs to implement a risk-based approach to financial crime prevention.

In addition to that, various monitoring rules can be created to monitor the transactions, for example, transaction velocity, payment count, allowed volume, suspected structuring, etc. In addition to that, all transaction details, for example, remitter/beneficiary name, remitter/beneficiary bank/PSP, are screened for any potential sanctions matches, PEP, and adverse media.

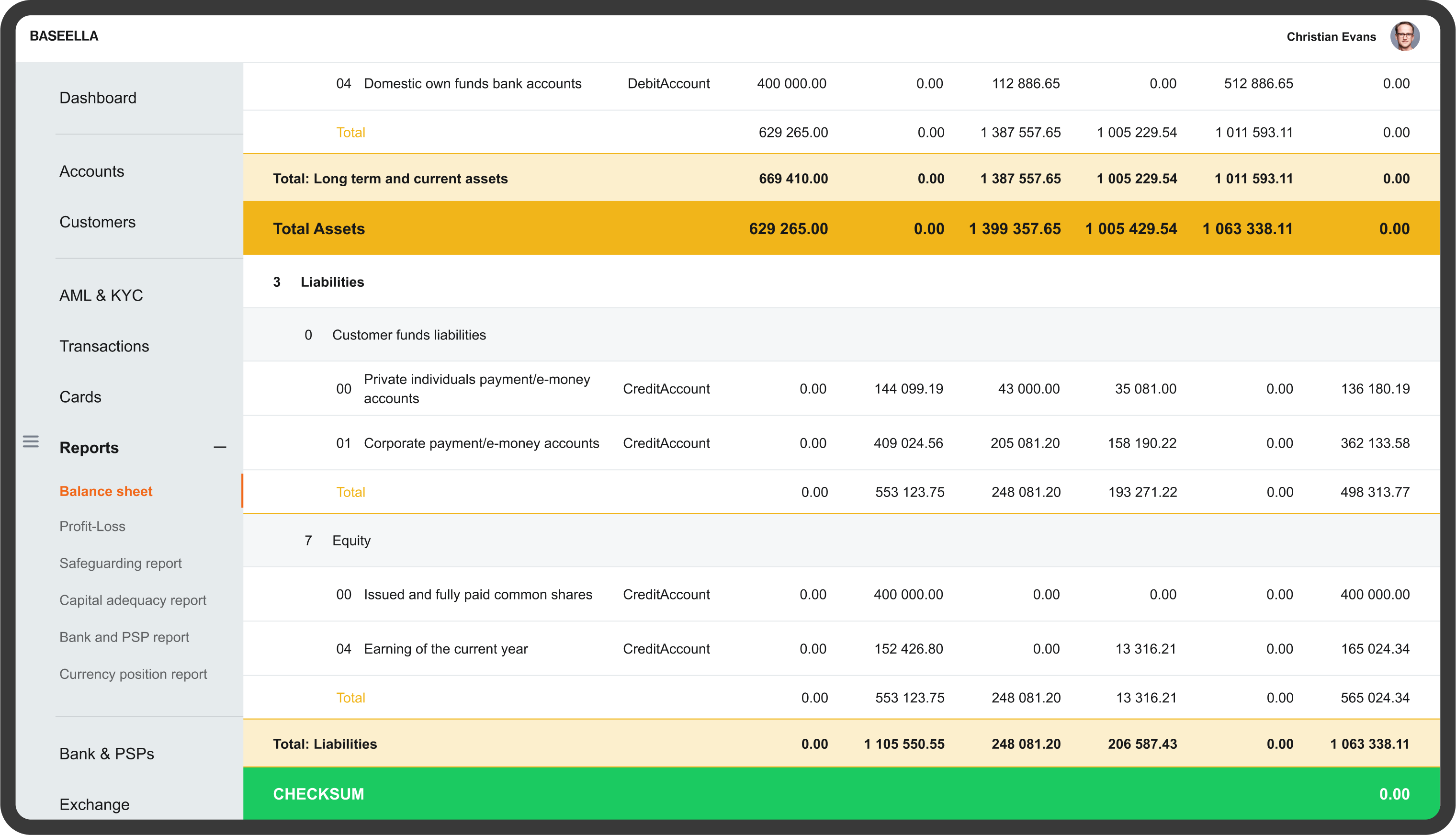

Balance sheet report

Since Baseella was created as an accounting system, there is no need to keep a separate set of financial accounts or use any additional accounting software. Instead, management can generate any financial report straight from the Baseella since it is the basis of our core banking system arthitecture.

The balance sheet is one of the most essential reports management can create with two clicks of the mouse. Moreover, it can be presented in different formats, including FRS102, EU IFRS, or any other accounting standard. The whole trial balance can be exported into Excel to simplify the auditor’s work.

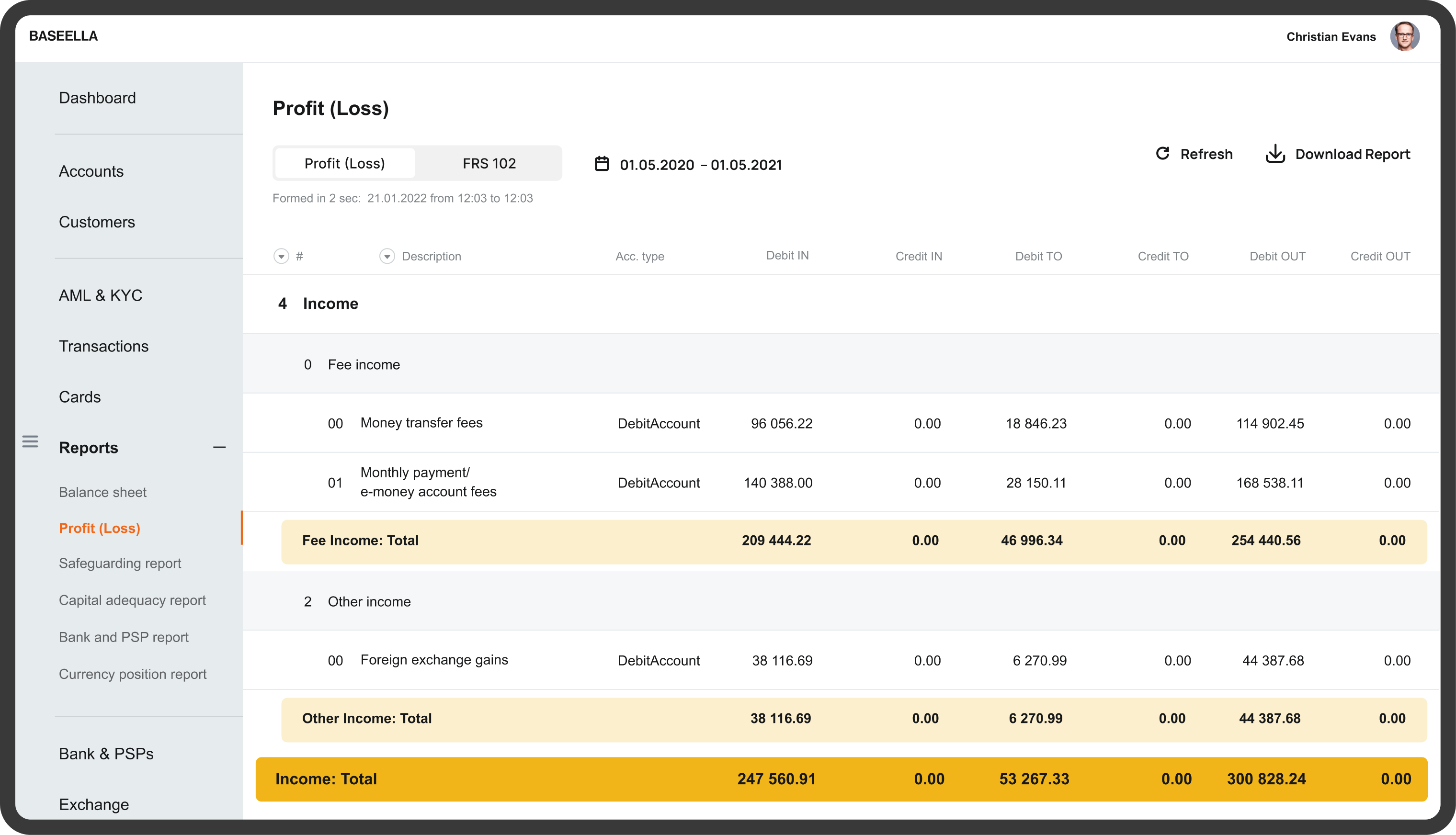

Profit (loss) report

Profit (loss) is arguably one of the most critical financial statements management would monitor frequently. Baseella core banking system generates such a statement in a matter of seconds. It is accurate to the extent that the employees entered all company expenses (that needed to be entered manually) in a timely manner, or accruals were made to account for such expenses.

Management can produce the profit (loss) forecast based on the company’s past performance and customer base growth metrics. One of Baseella core banking system features is a financial year closing procedure under which the revenue and expense account’s balances are merged into a past period profits (loss) account, and the new financial year starts.

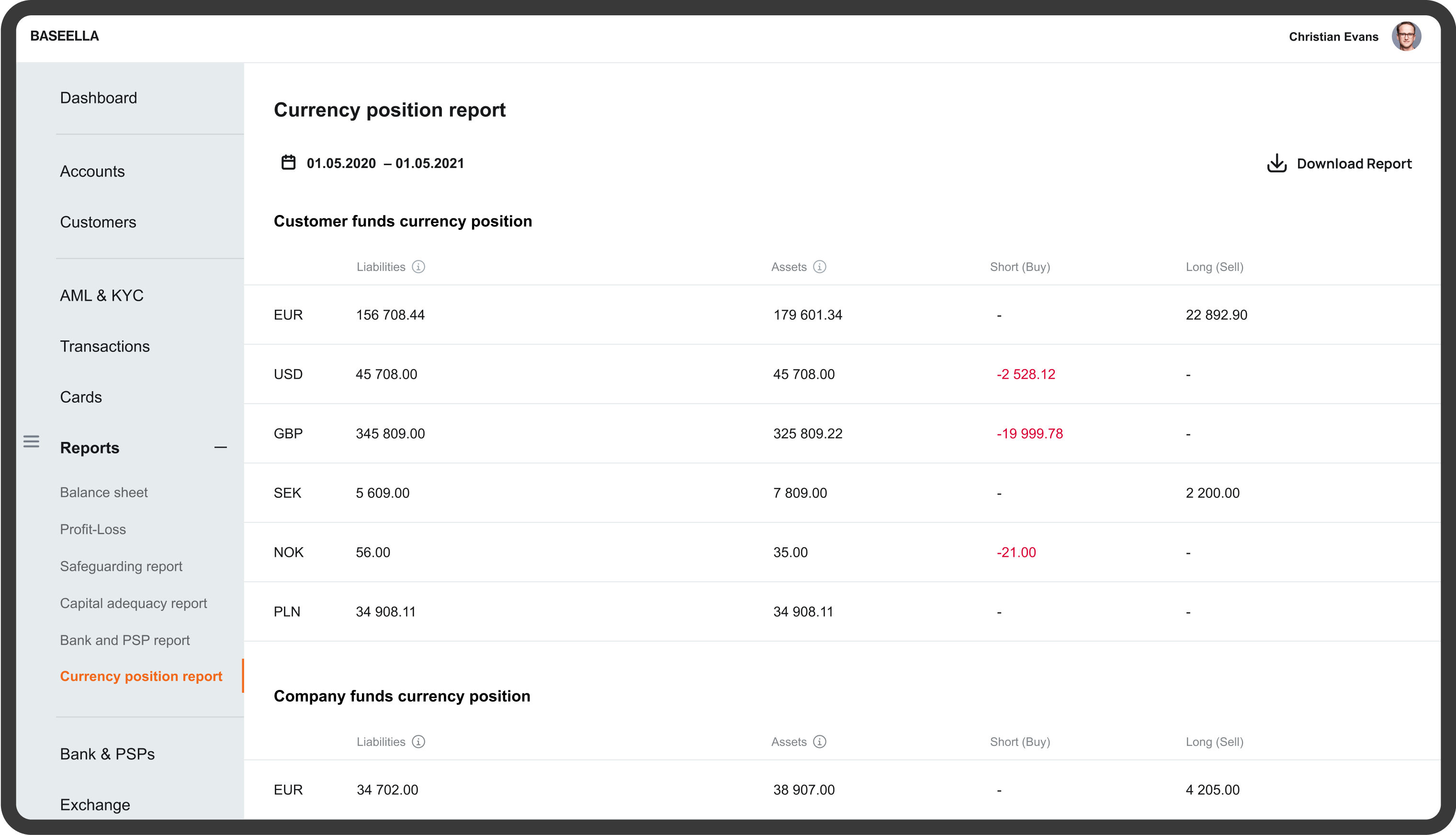

Open foreign currency position report

Currency exchange is one of the most important revenue sources of revenue for PayTech companies; most companies have revenues and expenses in various currencies. To monitor open currency positions, Baseella has a currency position report that clearly shows any long and short positions in any foreign currencies of PayTech.

Many PayTech companies employ an overall balance sheet approach to open currency position management. Under such an approach, low-value currency exchange transactions for matching currency pairs are conducted via internal SPOT. As a result, excess foreign currency liquidity is sold, or short foreign currency liquidity is bought on the market only a few times a day instead of doing it for each customer FX order. With our core banking system feature allowing to produce open currency position report, managing FX exposures is a breeze.

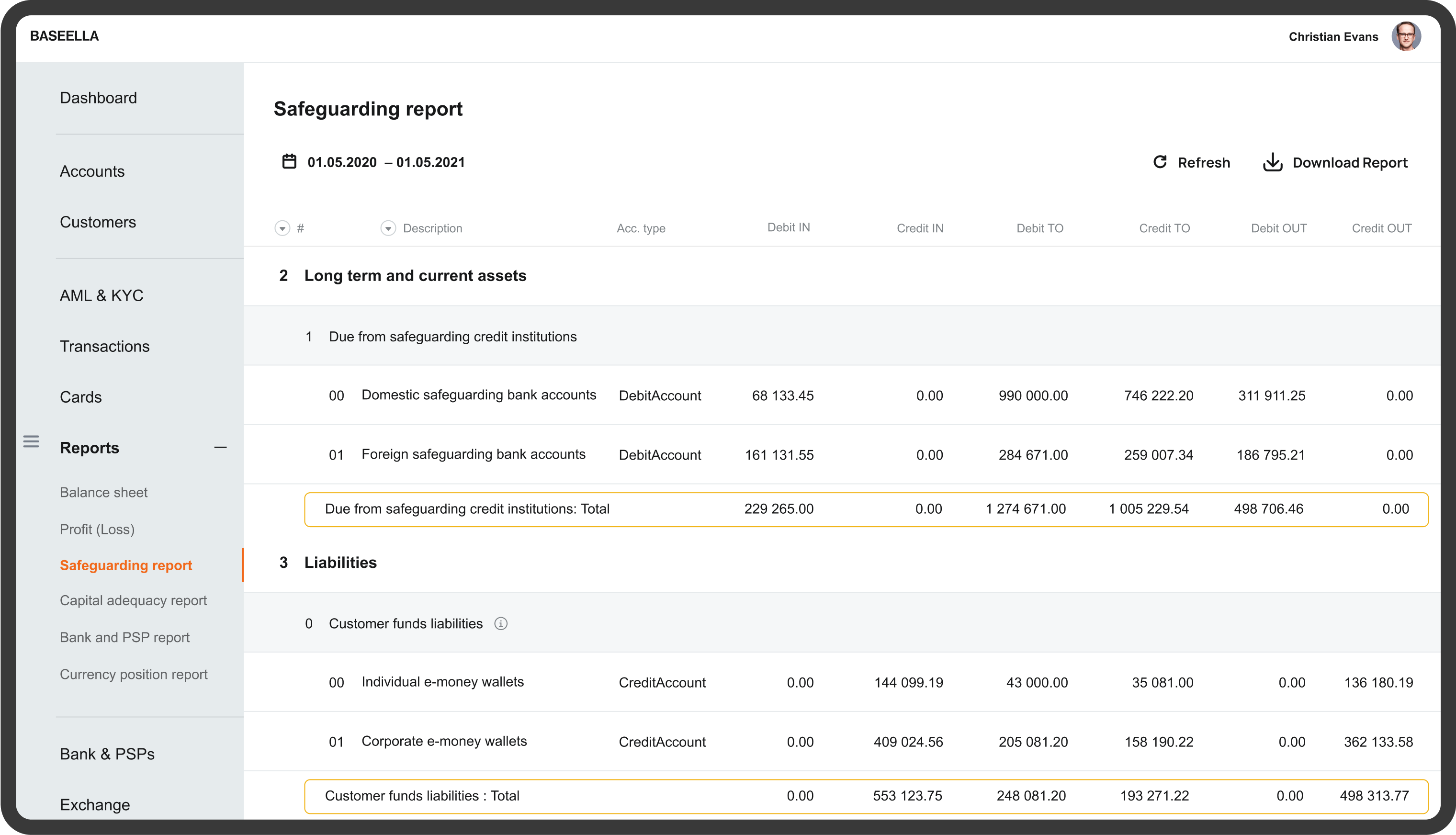

Safeguarding reconciliation report

Compliance with safeguarding obligations is one of the most critical responsibilities of any FinTech or PayTech company. Safeguarded customer’s funds must be reconciled against the customer’s funds liabilities at least once a day, and excess safeguarded funds (usually representing earned fees) must be removed from the safeguarding bank accounts to the company’s own funds bank account.

Baseella has a clear and easy-to-understand safeguarding reconciliation report, which is very useful for the companies, using the ‘net’ safeguarding process – under which an equivalent amount is held in the safeguarding accounts, rather than each transaction passing through the safeguarding accounts. Our core banking sytem architecture allows management to produce the report with two clicks of the mouse, identify any excess or shortage, and either remove the excess from the safeguarding bank accounts or pay in the shortage accordingly.

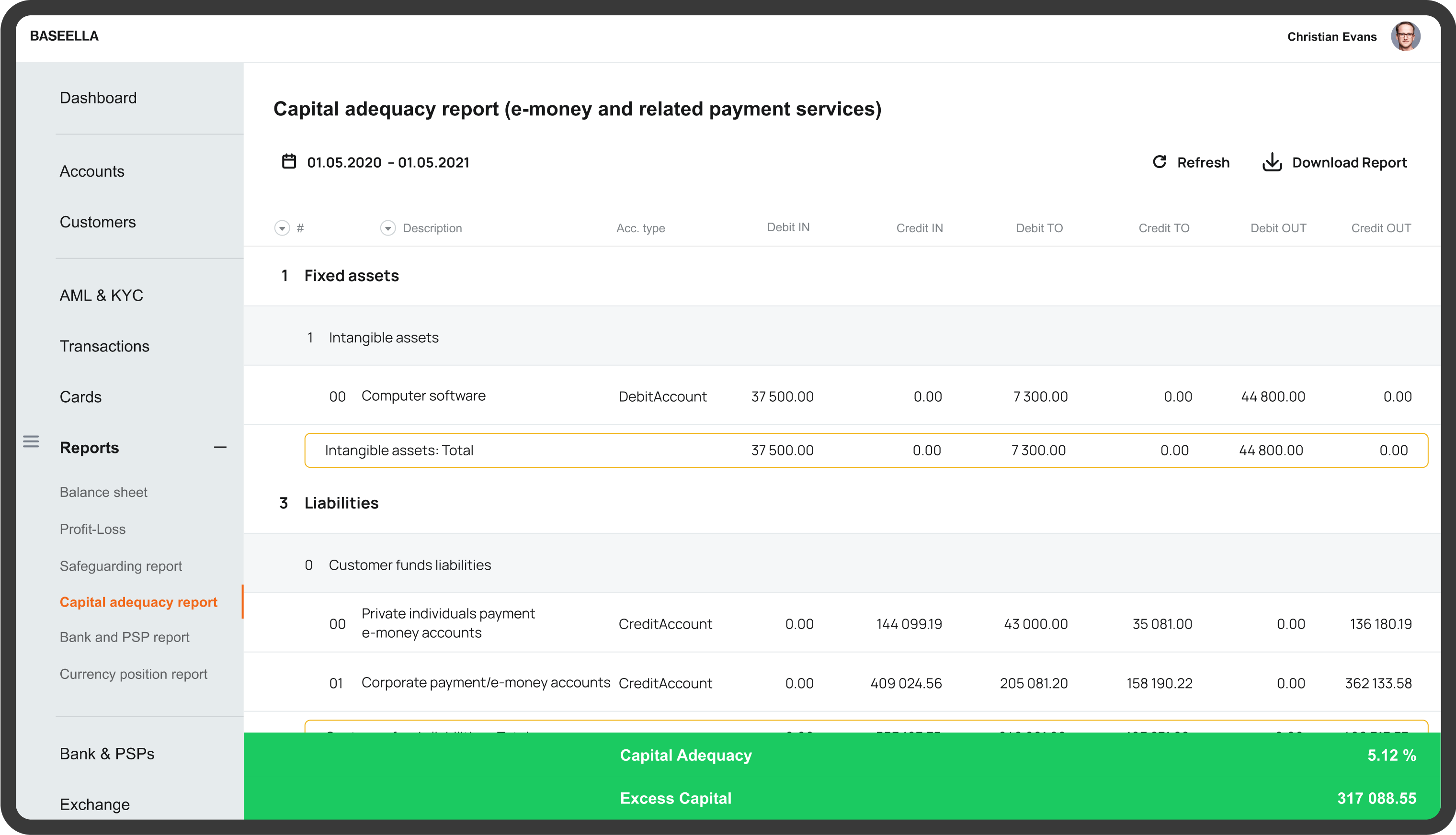

Capital adequacy report

Monitoring of the ongoing capital adequacy is critical to any FinTech/PayTech company. Therefore, Baseella has developed a fully-fledged ongoing capital adequacy reporting capability for any required calculation method. In addition, our core banking system features allows to produce a capital adequacy forecast that considers the company’s financial performance, client base growth and churn, outstanding e-money balance dynamics, payments volume, and other factors to remain compliant and plan for the near future.

The example in the screenshot is a method D reporting for the electronic money institution in the UK or EU, whose payment services are related to e-money issuance. Since Baseella’s core banking system architecture is built as a fully-fledged accounting system, and all revenues and expenses are recorded in the core, our clients can produce the capital adequacy report for non-e-money-related payment services for methods A, B, and C as well.

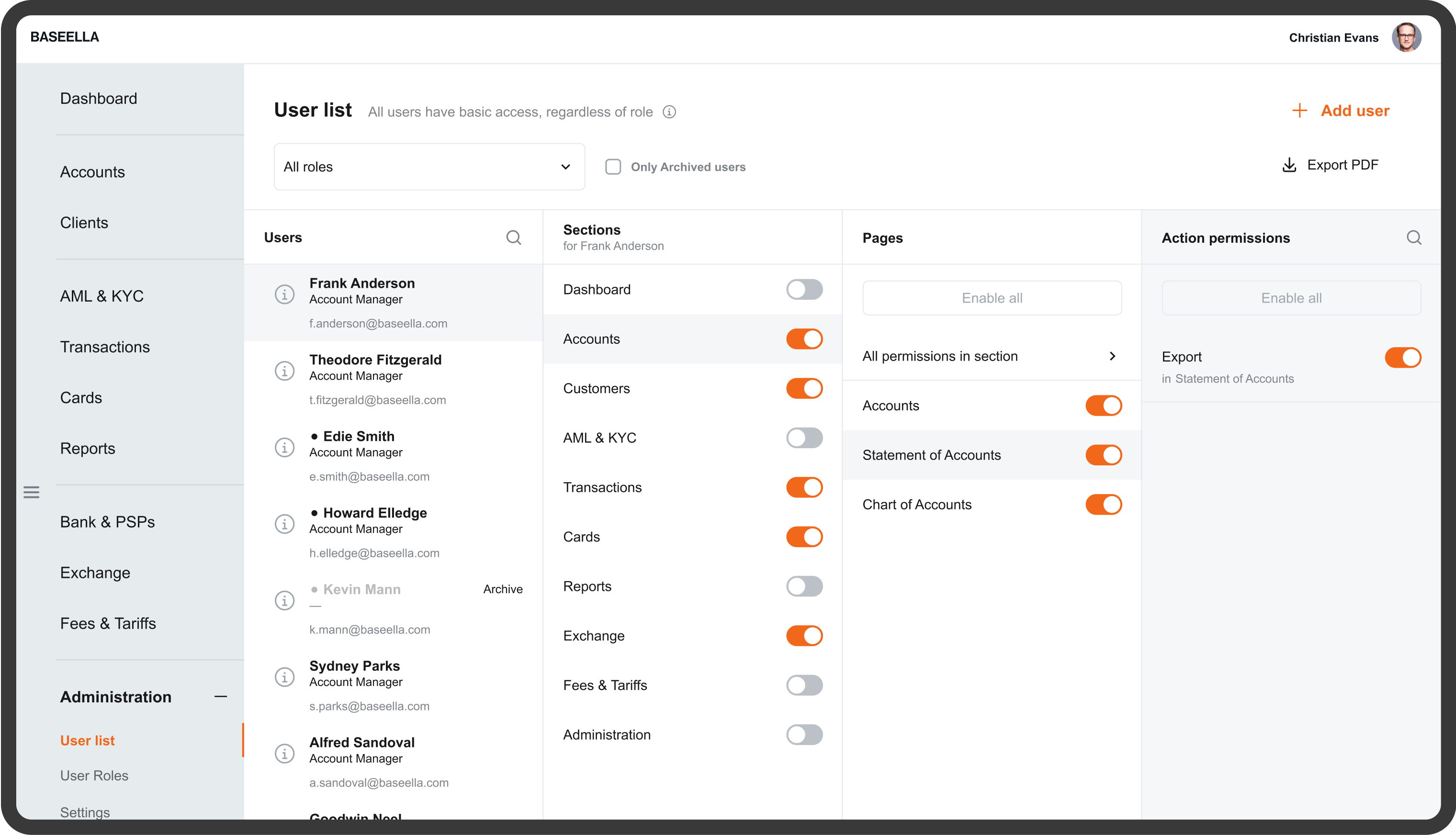

User management

Baseella offers comprehensive user management functionality, giving you complete control over user roles, permissions, and access levels at a granular level. With Baseella, PayTech firms can set up various roles and define corresponding rights based on their specific organisational structure and operational requirements. Multi-factor authentication (MFA) may be enabled for all or selected members of the team using the Baseella core.

We understand that protecting sensitive payment data and preventing financial crime are top priorities for PayTech firms. Baseella incorporates a comprehensive “four eyes” approval principle to address these concerns. This means that any movement of client funds, such as incoming or outgoing money transfer transactions, requires approval from multiple authorised employees. Our core banking system architecture ensures that you can set up transaction approval sequences based on your corporate governance and internal controls, regulatory requirements, and internal policies and procedures.